GOLD OUTLOOK & ANALYSIS

- Real yields limit gold upside as Fed cycle under scrutiny.

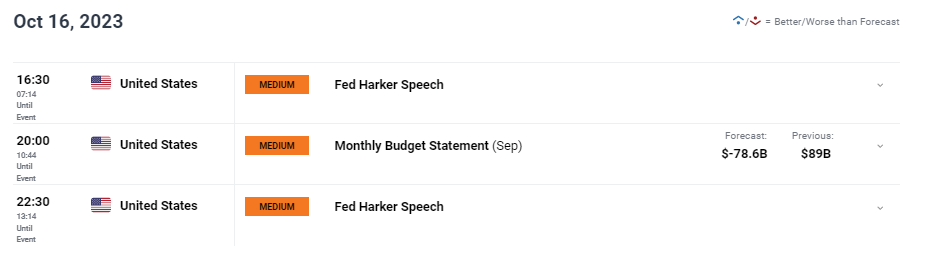

- Fed speakers in focus later today.

- Rejection at key resistance on daily gold chart.

Elevate your trading skills and gain a competitive edge. Get your hands on the Gold Q4 outlook today for exclusive insights into key market catalysts that should be on every trader’s radar.

XAU/USD FUNDAMENTAL FORECAST

Gold prices softened on Monday morning after a the largest upside rally since mid-March this year due to rising concerns between Israel and Hamas (safe haven demand). Since then there has been no real escalation in incoming news which has seen bullion taper off slightly but may well pick up again on any worsening news in the Middle East.

US real yields (see below) is marginally higher thus weighing on the non-interest bearing asset as US Treasury yields tick higher.

US REAL YIELDS (10-YEAR)

Source: Refinitiv

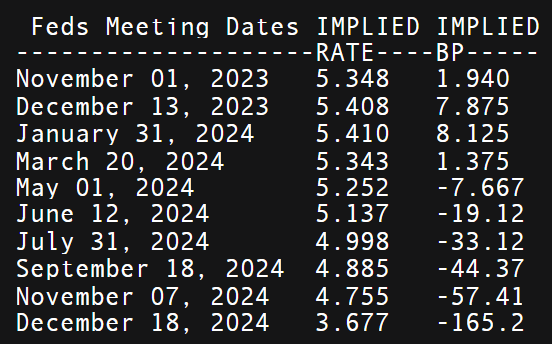

From a Federal Reserve perspective, markets have ‘dovishly’ repriced interest rate expectations (refer to table below), currently pricing in roughly 165bps of rate cuts by year end 2024. This drastic change suggests a possible peak to the Fed’s hiking cycle and may continue to buoy gold prices should this narrative gain traction through weaker US economic data and less aggressive Fed talk. Fed guidance will continue today but the focal point for the week will come from US retail sales data tomorrow, additional Fed speakers including Fed Chair Jerome Powell and jobless claims data.

IMPLIED FED FUNDS FUTURES

Source: Refinitiv

GOLD ECONOMIC CALENDAR

Source: DailyFX

Want to stay updated with the most relevant trading information? Sign up for our bi-weekly newsletter and keep abreast of the latest market moving events!

TECHNICAL ANALYSIS

GOLD PRICE DAILY CHART

Chart prepared by Warren Venketas, IG

Daily XAU/USD price action shows the pair respecting the longer-term trendline resistance zone (black), coinciding with the 200-day moving average (blue). Due to the external factors at play, there could be investors looking to look for long opportunities at support levels; however, due to the fact that the war in the Middle East remains relatively contained within the region, gold may not appreciate as many would expect. That being said, should the war spillover and see other nations implicated, the contagion effect will likely support a sharp rise in gold prices.

Resistance levels:

- 1950.00

- Trendline resistance/200-day MA (blue)

- 1925.06

Support levels:

- 1900.00/50-day MA (yellow)

- 1884.89

- 1858.33

IG CLIENT SENTIMENT: BULLISH

IGCS shows retail traders are currently distinctly LONG on gold, with 71% of traders currently holding long positions (as of this writing).

Curious to learn how market positioning can affect asset prices? Our sentiment guide holds the insights—download it now!