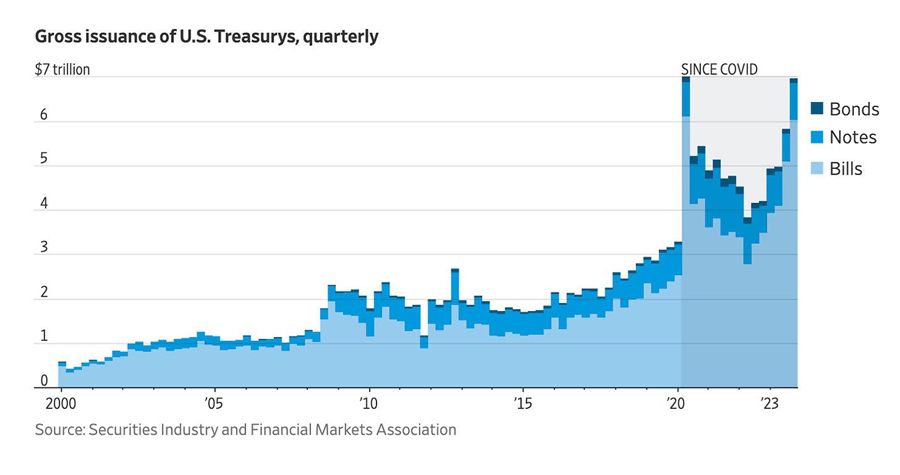

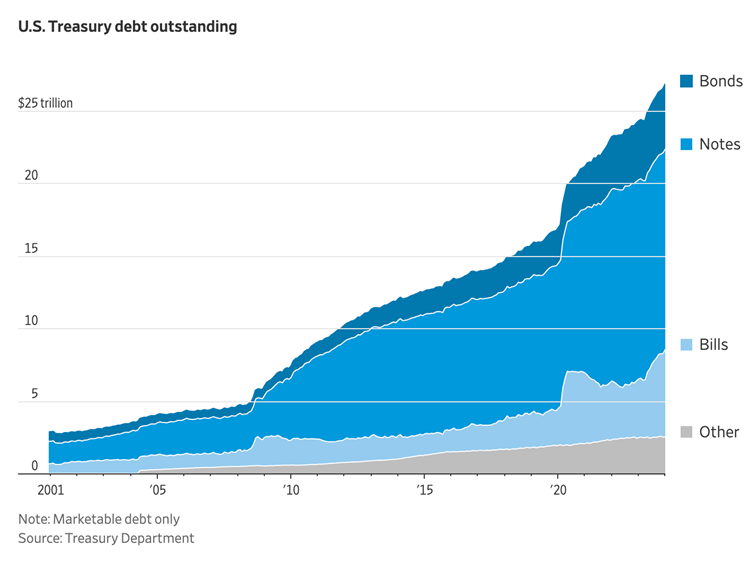

If you thought there was a steady hand guiding the nation’s finances, think again. The Department of Treasury has officially reached debt levels comparable to those seen during the height of the pandemic. The latest data for Q4 2023 reveals that the Treasury has issued a staggering $7 trillion in new debt, bringing the total for the year to a whopping $23 trillion. This surge has inflated the Treasury market to $27 trillion, marking a 60% increase since the pandemic began. To put it into perspective, one-third of all Treasuries now have fresh ink, a stark contrast to pre-pandemic levels.

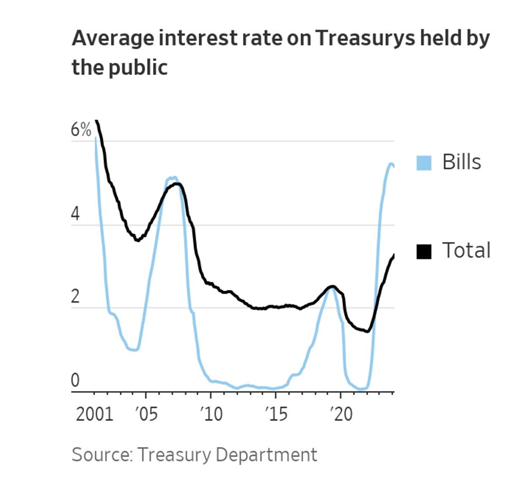

The rate at which federal debt is rising is alarming, with the government accumulating an additional $1 trillion in debt every 90 days. This trend has pushed US government spending as a percentage of GDP to unprecedented levels since World War II. But why is there such a dramatic increase in debt? The answer is simple: it’s being used to spur economic growth.

As Balaji Srinivasan succinctly puts it, “The economy isn’t real. It’s propped up by debt. They will fake it till they break it.” Even mainstream outlets like the Wall Street Journal are sounding the alarm, warning that rapid debt growth often ends in disaster. Given the massive size and perceived safety of the Treasury market, any instability could have catastrophic consequences.

Why is this so concerning? Because US treasuries are treated as cash equivalents by banks, pension funds, corporations, and individual investors. However, unlike cash, treasuries are essentially IOUs from the government, promising repayment with interest later. If investors were to lose faith in Uncle Sam’s ability to repay its debts, it could trigger a domino effect of defaults across the financial system.

What’s particularly concerning is that neither voters nor Congress seem to grasp the gravity of the situation entirely. Despite the growing mountain of debt, there’s a pervasive belief that Uncle Sam will always honour its obligations. However, every fiscal trend points in the wrong direction, with deficits set to soar even higher in the event of a recession.

At this juncture, there’s little standing between us and fiscal collapse. The only question that remains is when it will happen.