JustMarkets Review

- Leverage: 1:30 | 1:3000

- Regulation: FSCA, CySEC, FSA, FSC

- Min. Deposit: $10

- HQ: Seychelles, Cyprus

- Platforms: MT4, MT5

- Found in: 2012

JustMarkets Licenses:

- Just Global Markets (PTY) Ltd – authorized by FSCA ( South Africa) license no 51114

- JustMarkets Ltd – authorized by CySEC (Cyprus) license no 401/21

- Just Global Markets Ltd. – authorized by FSA (Seychelles) license no SD088

- Just Global Markets (MU) Limited – authorized by FSC (Mauritius) license no GB22200881

It has been in business since 2012 and is a global Forex and CFD trading company. Looking into it, we found that the company offers many different kinds of financial goods, such as CFDs on Forex, Gold, Oil, Indices, Metals, Cryptos, and Shares.

How do I read JustMarkets Review?

JustMarkets Broker used to be called JustForex, and it only did business in offshore zones for a long time. After changing its name, though, JustMarkets got good licenses from the Financial Sector Conduct Authority (FSCA) in South Africa and the Cyprus Securities and Exchange Commission (CySEC). Since this great step was taken, broker was seen as a safe place to trade and is now known as a trusted choice for traders, making sure their safety and security.

Overall, JustMarkets offers competitive trading conditions at this time, such as low spreads and fast processing. It also gives users access to the MetaTrader trading tools, which are used and trusted by traders all over the world.

The pros and cons of JustMarkets

From what we’ve learned, there are both good and bad things about JustMarkets that you should think about before picking them as your trader. For professionals, the company offers the well-known MT4 and MT5 trading systems, which can be used for a range of trading methods and by buyers of all kinds. One more benefit is that the spreads are competitive and start at 0 pips. You can also choose very high leverage of up to 1:3000, though this may change based on the company. JustMarkets also offers competitive study and training materials that are important for both new and experienced buyers.

As for the cons, trade conditions may change based on the rules. One more problem to think about is the small number of trade tools that are based on organizations. Also, the company has only been active in foreign zones for a long time, so you should do your own study to see if the service is right for you.

Click here to read Pepperstone Review

| ✔️ Advantages | ❌ Disadvantages |

|---|---|

| Competitive spreads | Trading conditions might vary based on the entity |

| MT4 and MT5 trading platforms | Financial instruments might vary depending on the regulation |

| Multiregulated | |

| Different strategies available | |

| MAM (Multi Account Manager) | |

| Available for European and international traders | |

| 24/7 customer support | |

| Comprehensive learning materials |

Honors and Awards

The Ultimate Best Brokers & B2B Fintech Awards 2023 named JustMarkets the Best Broker in Africa, which we found out. Another honor the broker won in 2022 was being named the Best Broker in Asia and the Best Forex Trading Platform.

Is JustMarkets a scam or a safe site?

Not at all, JustMarkets is not a fake. This is a trustworthy Forex company that is regulated by the well-known South African FSCA and the European CySEC. It also has other licenses. To make sure the broker acts in a trustworthy way, this governing body applies strict rules and guidelines.

Does JustMarkets work?

Yes, JustMarkets is a real dealer that follows the rules.

The fact that JustMarkets follows the rules set by CySEC and FSCA makes buyers feel safer and more confident when they trade with them.

Check out our final thoughts on JustMarkets Reliability:

Because they have a good name and offer good services, our Ranked JustMarkets Trust Score is 8.5 out of 10. However, buying services for people from other countries are also provided by companies based outside of the country, which means that security is lower.

| JustMarkets Strong Points | JustMarkets Weak Points |

|---|---|

| Segregated accounts | None |

| Negative balance protection | |

| Data transfer protection | |

| Data storage protection |

How do you stay safe?

According to the research we did, JustMarkets has a number of safety rules in place to keep clients’ money safe in line with legal requirements. These include keeping client money separate from the company’s own accounts and not using them for business reasons. The company also offers negative balance protection, which keeps buyers’ accounts from going into negative balance when the market is volatile or when something unexpected happens.

Use of leverage

People who want to trade on the Forex market but don’t have a lot of money can use leverage to their advantage. But it works both ways, so it can lead to big gains or loses. Because of this, it is strongly suggested that you fully comprehend leverage before initiating any trade activities that involve its use.

JustMarkets offers leverage in line with the rules set by FSCA, CySEC, FSA, and FSC:

- The biggest amount of time that European traders can use for major currency pairs is 1:30 for regular clients and 1:300 for business customers.

- Traders from other countries can use up to 1:3000 in leverage.

Different Types of Accounts

We looked at the broker’s account types and found that buyers can choose between Standard Cent, Standard, Pro, and Raw Spread accounts on MT4. Standard, Pro, and Raw Spread are the account types that can be used on the MT5 website. It is also possible for buyers at JustMarkets to change their trading accounts into Islamic or swap-free accounts.

That being said, the account types may not be available to all institutions. To make sure you have a full idea of all the choices, it is recommended that you do a lot of study.

There is also a Demo account that new buyers can choose from that is free of charge. So, they can practice investing and try out different tactics with “trial trades.”

| 👍🏻 Pros | 👎🏻 Cons |

|---|---|

| Fast and easy account opening | None |

| Demo and Islamic accounts | |

| Account base currencies USD, EUR, GBP, and ZAR | |

| $10 is the minimum deposit amount |

How to Sign Up for a Live Account at JustMarkets?

It’s easy to open an account with a trader and use JustMarkets Login. You can open an account in minutes by going to the official website’s starting account or sign-in page and following the steps given:

- Pick out the “Open an Account” page and click on it.

- Type in your personal information (name, email address, phone number, etc.).

- Uploading proof of residency, ID, or other information will help us check your personal information.

- Finish the online test to prove you know how to trade.

- After your account is verified and active, you can send money.

No-Deposit Bonus to Trade

It’s also a nice idea to use the No Deposit Bonus Program or one of the other programs that Just Markets has to offer as part of their marketing to help buyers with their selling. But keep in mind that the rules are different for each company, and some programs may only be available for a short time, so it’s a good idea to check to see if you can get awards or not. Check out some of the terms and conditions for the Trading Bonus below. These bonuses don’t apply to CySEC accounts and are mostly only for FSA clients:

- Traders who want to get a No Deposit Trading Bonus must first open a Welcome Account (which is only for new clients) and trade $30 in any way they choose (that is not subject to CySEC). (only FSA).

- A client can also get an extra of up to 120% on their deposit, which is called a “Deposit Bonus.”

- Finally, buyers can get $50 for each friend they get to join the trading program.

Tools for Trading

JustMarkets offers many well-known financial markets, such as CFDs on Forex, Gold, Oil, Indices, Metals, Shares, Cryptocurrency, and more. The most liquid of these markets is Forex, which has starting rates as low as 0 pip and is also the most traded. However, the trade tools that are available may be different for each company. To get a full picture of all the choices that are out there, it is recommended that you do a lot of study.

The JustMarkets Markets Range Score is 8.5 out of 10 for having a lot of trade instruments to choose from. But you can’t invest in a lot of popular asset types, like futures and stocks, so you might want to look at other Brokers as well.

Fees for JustMarkets

Based on what we found, the broker’s trade prices are very low compared to others, and there are no secret fees. However, based on the funding method chosen and the area of registration, there may be fees for both payments and withdrawals. Traders should also be aware that they might have to pay extra fees, like shift or rollover fees, when they trade.

After checking and comparing JustMarkets Fees to those of over 500 other firms, we found that they are low or average, giving them a total score of 8.3 out of 10. Read on for more comparison information:

| Fees | JustMarkets | VPFX Fees | NCM Investment Fees |

|---|---|---|---|

| Deposit fee | Yes | Yes | Yes |

| Withdrawal fee | Yes | Yes | Yes |

| Inactivity fee | No | No | No |

| Fee ranking | Low/Average | Average | Average |

Spreads

According to our test deal, JustMarkets offers tight and floating spreads, with an average spread of 0.1 pips for the heavily traded EUR/USD currency pair on the Forex market. This is a good choice for traders, since the average spread in the industry is 1.2 pips. The broker also offers rates that are competitive for other major currency pairs and well-known trade products. But trade conditions may be different for each business, so it’s important to do a lot of study to find out exactly what the spread conditions are.

After checking them against other traders, we found that JustMarkets Spreads are low or average, giving them a total score of 8.6 out of 10. The spread for Forex was lower than the average for the industry, and the spreads for other assets are also competitive. This is good for a number of trading techniques, such as Trend Trading and Scalping.

| Asset/ Pair | JustMarkets Spread | VPFX Spread | NCM Investment Spread |

|---|---|---|---|

| EUR USD Spread | 0.5 pips | 1.2 pips | 2 pips |

| Crude Oil WTI Spread | 2 | 3 | 3 |

| Gold Spread | 1.1 | 1 | 1 |

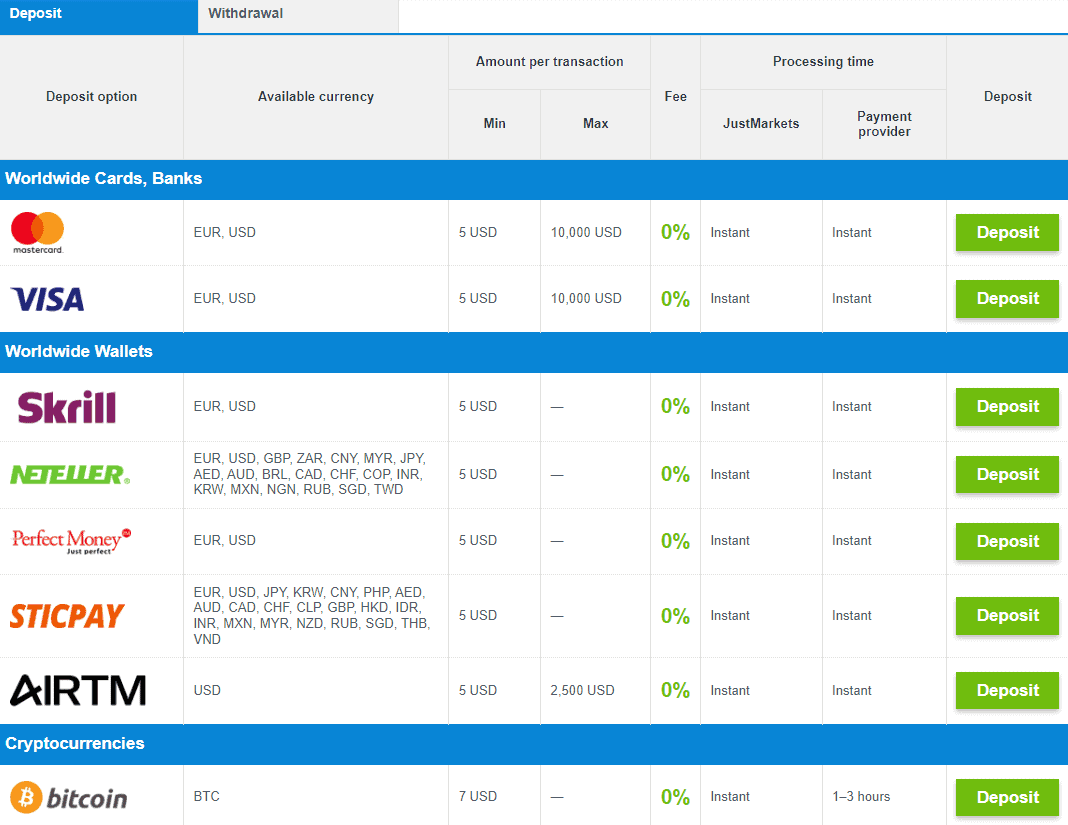

Making deposits and withdrawals

The company gives buyers a number of ways to fund their trading accounts, such as bank wire transfers, credit/debit cards, and online payment systems such as Skrill, Neteller, Perfect Money, and others. However, the exact requirements and limits for each funding way may be different based on the bank and the country where you live.

We gave JustMarkets Funding Methods an average score of 8.5 out of 10, which means they were good. There aren’t many fees, and you can use a number of account-based funds.

Here are some good and bad things about the ways that JustMarkets gets money:

| JustMarkets Advantage | JustMarkets Disadvantage |

|---|---|

| Fast digital deposits | Methods and fees might vary in each entity |

| Multiple account base currencies | |

| Popular funding methods |

JustMarkets Minimum Deposit

To open a live trading account with the broker, you need to deposit $10 as an initial deposit amount for a Standard account in the South African entity, which is considered a good offering overall.

JustMarkets minimum deposit vs other brokers

| JustMarkets | Most Other Brokers | |

| Minimum Deposit | $10 | $500 |

JustMarkets Withdrawals

Traders can expect an easy and quick withdrawal process with JustMarkets, enabling them to access their funds efficiently. As we found, the withdrawal requests are typically processed within 1-2 hours for most withdrawal methods.

How Withdraw Money from JustMarkets Step by Step:

- Login to your account

- Select Withdraw Funds’ in the menu tab

- Enter the withdrawn amount

- Choose the withdrawal method

- Complete the electronic request with necessary requirements

- Confirm withdrawal information and Submit

- Check the current status of withdrawal through your Dashboard

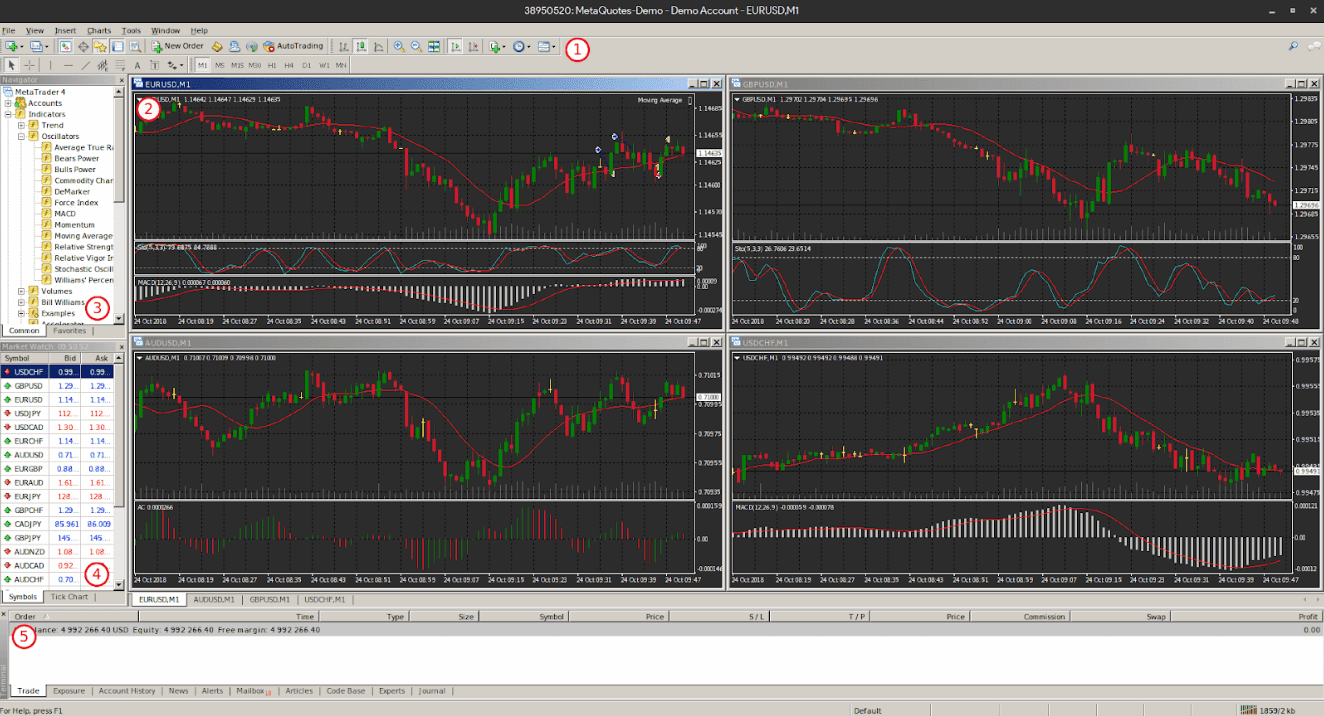

Trading Platforms

South African entity traders have access to two popular and widely-used trading platforms, MetaTrader 4 and MetaTrader 5, which are renowned for their user-friendly interfaces, wide range of features, and the ability to engage in automated trading. JustMarkets also enables access to Copy Trading allowing traders to automatically copy leading traders and benefit from their success. As per our findings, the platforms are available via web, desktop, and mobile devices, enabling traders to stay connected to the markets and trade conveniently at any time.

- JustMarkets Platform is ranked good with an overall rating of 8.9 out of 10 compared to over 500 other brokers. We mark it as good since it offers the popular MT4 and MT5 professional trading platforms.

| Platforms | JustMarkets Platforms | VPFX Platforms | NCM Investment Platforms |

|---|---|---|---|

| MT4 | Yes | Yes | Yes |

| MT5 | Yes | Yes | Yes |

| cTrader | No | No | No |

| Own Platforms | No | No | No |

| Mobile Apps | Yes | Yes | Yes |

Trading Tools

According to our analysis, the broker offers a diverse range of trading tools and solutions which include advanced charting features with multiple chart types, various timeframes, trading signals, an economic calendar, and technical indicators. Additionally, the MetaTrader platforms facilitate automated trading with the help of Expert Advisors (EAs) and algorithmic trading.

JustMarkets also integrates a Multi Account Manager (MAM) software, enabling money managers to efficiently execute bulk orders across an unlimited number of accounts.

Customer Support

The broker provides 24/7 multilingual customer support through Live chat, Email, Phone, and Social Media. The experienced trading specialists are readily available to assist traders with a wide range of matters, including technical issues, market analysis advice, general inquiries, and other different concerns.

- Customer Support in JustMarkets is ranked good with an overall rating of 8 out of 10 based on our testing. We got fast and knowledgeable responses, and also it is easy to reach during the working days and the weekends.

See our find and ranking on Customer Service Quality:

| Pros | Cons |

|---|---|

| Live chat, phone support, email, social media | None |

| 24/7 customer support | |

| Quick responses | |

| Relevant answers |

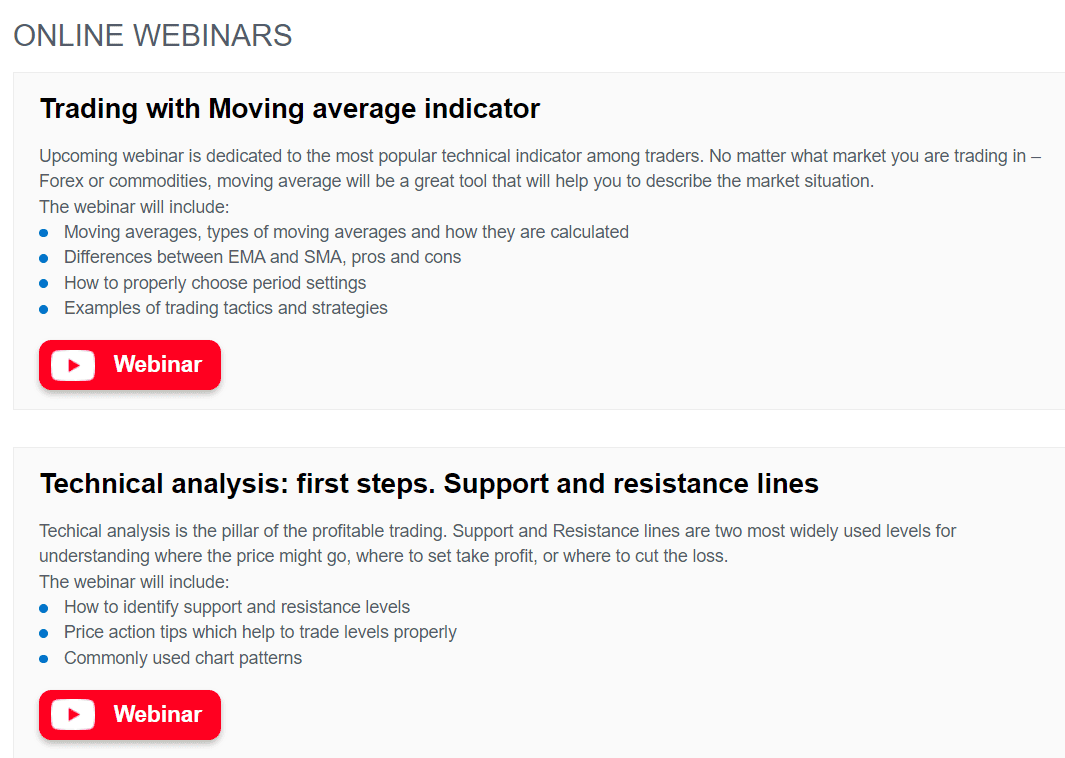

JustMarkets Education

We noticed that the broker offers comprehensive educational and research materials on its website including webinars, Forex articles, educational videos, daily forecasts, economic calendar, market news, and more.

Moreover, JustMarkets offers a demo account feature that enables traders to practice their trading strategies in a risk-free environment without using real money.

- JustMarkets Education ranked with an overall rating of 8 out of 10 based on our research. We found that the broker offers good-quality of educational materials and analysis.

JustMarkets Review Conclusion

Concluding JustMarkets Review we now state it a s good option for Forex and CFD trading that offers a secure and competitive trading environment. The broker now operated with good licenses and expanded its brand globally, so is considered a saafe choice. Also, Broker provides a range of popular trading instruments, catering to the diverse needs of traders. The availability of popular trading platforms like MT4 and MT5 further enhances the trading experience.

While there may be some drawbacks such as varying trading conditions, JustMarkets still considered a competitive choice for traders at all skill levels. The broker’s transparent fee structure, quick withdrawal process, 24/7 customer support, and extensive educational resources, including webinars, articles, and market research, contribute to its overall appeal. However, you should conduct your research as well, and consider personal trading needs, before selecting JustMarkets as your preferred broker.

Based on Our findings and Financial Expert Opinions JustMarkets is Good for:

- Traders from Europe

- International traders

- Traders from Africa Region like Namibia, Zambia etc

- CFD and currency trading

- Traders who prefer the MT4 and MT5 platforms

- Beginners

- Advanced traders

- Muslim trading

- Market Making execution

- Competitive fees and low spreads

- EA/Auto trading

- Good trading tools

- Copy Trading

- Comprehensive learning materials

- Supportive 24/7 customer support