Eightcap Review

- Leverage: 1:500

- Regulation: ASIC, SCB, CySEC, FCA

- Min. Deposit: 100 US$

- HQ: Australia

- Platforms: MT4, MT5, TradingView

- Found in: 2009

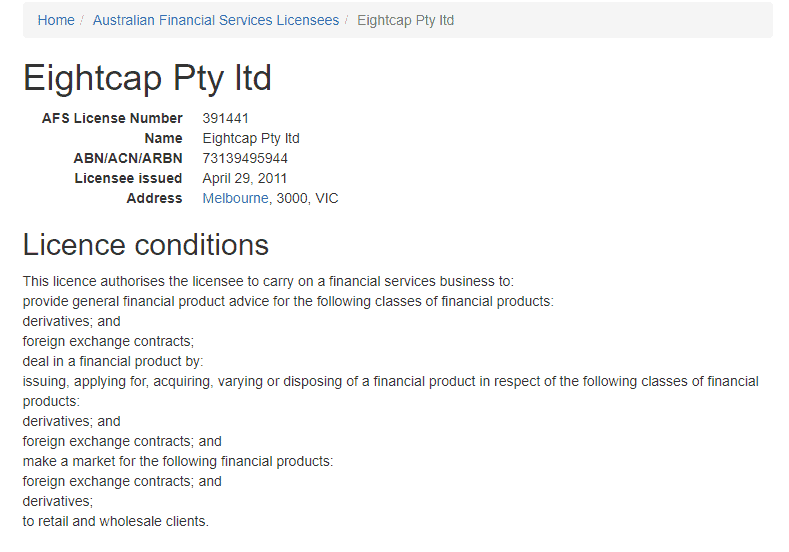

Eightcap Licenses

- Eightcap Pty Ltd – authorized by ASIC (Australia) registration ABN 73 139 495 944 AFSL 391441

- Eightcap Global Limited – authorized by SCB (The Bahamas) registration SIA-F220

- Eightcap EU Ltd – authorized by CySEC (Cyprus) registration HE 329922

- Eightcap Group Ltd – authorized by FCA (UK) registration FRN 921296

Eightcap

Eightcap is an Australian incorporated brokerage company, Forex and CFD Broker which brings a transparent pricing model since 2009 through low rates of variable spreads with quotes that are coming from numerous leading banks or institutions and performed via technological solutions through Equinix servers.

See also: Lux Trading Firm: The Ultimate Review for Aspiring Investors

Where is EightCap based?

Eightcap performs a global operation through their reputable Australian HQ and other international office based in the Bahamas. Eightcap maintains a home for MT4 and MT5 traders and aims to provide them with a personalized trading experience. This broker gives access to the most popular financial instruments, all with rapid execution and low spreads, via the award-winning MetaTrader platforms.

Apart from offering to retail clients, this broker also brings technological advantages and partnership opportunities to affiliates, IBs and influencers.

EightCap Pros and Cons

EighCap is a reliable broker, also provides good technological base for trading, costs are good and there is great research included in MT4 platform. Instruments are widely presented, and you can withdraw fund using various methods, which overall is quite a good established offering with our opinion.

From the negative points, there is no good learning materials essential for beginners, also no 24/7 support centers, besides mainly accounts are opened under Bahamas entity which does not provide high customer security like ASIC based EightCap.

| ✔️Advantages | ❌Disadvantages |

|---|---|

| Regarded broker with good reputation | Conditions and trading costs vary according to entity |

| Wide range of instruments available | Education is limited |

| Low Spreads for Forex | No 24/7 Support |

| Good Platform selection | |

| Professional Research |

EightCap Review Summary in 10 Points

| Headquarters | Australia |

| Regulation | ASIC, SCB, CySEC, FCA |

| Platforms | MT4, MT5, TradingView |

| Instruments | Currencies, oil, gold, silver, global indices, shares and cryptocurrencies |

| EUR/USD Spread | 1.0 pips Standard Account |

| Demo Account | Provided |

| Minimum deposit | $100 |

| Base currencies | USD, AUD |

| Education | Analysis and research |

| Customer Support | 24/5 |

Overall EightCap Ranking

With our Expert finds and overall review EigtCap proposal is quite good for Forex or CFDs traders. We found good technology provided, low spreads compared to industry offering and overall good trading conditions.

- EightCap Overall Ranking is 8 out of 10 based on our testing and compared to over 500 brokers, see Our Ranking below compared to other industry Leading Brokers.

Is Eightcap safe to trade with?

EightCap is not a scam, it is a low-risk trading broker due to a strict regulatory or compliance culture done by a reputable license and follow of regulations set by the Australian Securities and Investments Commission (‘ASIC’), a recognized world authority that regulates Forex and trading industry.

Also, Eightcap is a brand of Eightcap Group Ltd which is authorised and regulated by the Financial Conduct Authority, FRN 921296. Eightcap Group Ltd is a company registered in England and Wales with registration number 12448314.

Eightcap Group Ltd offers CFD trading on over 600 markets across forex, indices, commodities, and shares. Eightcap’s UK entity is the only dedicated, specialist TradingView broker in the UK, providing a tailored product experience to get the most out of trading via TradingView.

Our conclusion on EightCap Reliability:

- Our Ranked Eighcap Safety Score is 8 out 0f 10 for good service along the years and excellent service via an Australian entity. Yet, international traders are operating via offshore zone with lower requirements. So, we advise opening an account at EightCap ASIC regulated for better safety.

| EightCap Strong Points | EightCap Weak Points |

|---|---|

| License from Australia ASIC | International Trading under Offshore regulations |

| Negative Balance Protection applied | Safety measures vary based on entity |

| Customer Protection | |

| Good Reputation |

Is EightCap available in Nigeria?

Since Eightcap serves an additional entity that serves global clients from its offshore branch based in the Bahamas almost all International traders including Nigeria can open account under this entity. Of course, we do not recommend trading with solely offshore brokers, however, since Eightcap also follows reputable license from ASIC it means the broker is sharply regulated in terms of its operation.

- Australia regulated entity EightCap meets the highest standard of corporate governance, financial reporting, and disclosure. All retail client funds are kept separately from business funds in segregated bank accounts with AA-rated banking institution. Furthermore, EightCap undertakes additional protection by the professional indemnity insurance policy which all in all brings you a clear state of mind and trustable cooperation.

EightCap Leverage

One of the great features of Forex trading is an allowance to use leverage, which may increase your potential gains timely. However and in order to help traders in minimizing risks, which of course requires you to study well how to use leverage smartly.

Eightcap Leverage has specific restrictions according to the trading size you operate and entity you trade.

- Eightcap Australia allows leverage of up to 1:30

- International Traders may access high leverage

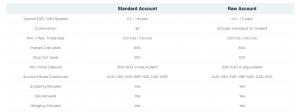

Account types

EighCap 2 account types offer of a simple choice between two accounts, either trade with Standard conditions with no complications all built into a spread or through Raw Account with spreads from 0.0 pips and commission for professional traders. See some of our finds below:

| Pros | Cons |

|---|---|

| Fast digital account opening | Conditions vary based on entity rules |

| Options between Spread only or Comission based Accounts | |

| Demo Account |

Trading Instruments

The broker offers 800+ instruments, including major and minor currency pairs, oil, gold, silver, shares, cryptocurrency CFDs, and indices.

The broker also constantly expanded its prooposal, like we saw it add now Stock CFDRange by adding ASX Share CFDs, NASDAQ Share CFDs, NYSE Share CFDs, LSE Share CFDs, German Share CFDs.

- Eighcap Instrument Score is 8 out 0f 10 for good trading instrument proposal and constant improvement and adding new instruments. However, we see the range of instruments is different based on entity.

Eightcap Fees

EighCap fees mainly built into a spread if you use Standard account or into a commission basis for Raw accounts. However, for full fee structure refer to the comparison table below and see all applicable fees for EighCap, see our find below.

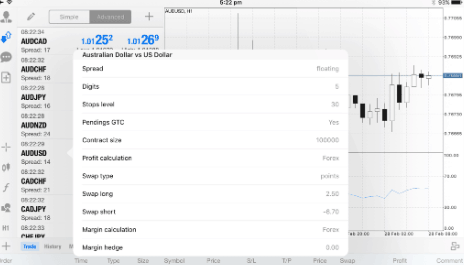

Also, always consider overnight fee as a cost also referred to as Rollover rate, an interest for holding positions open overnight in foreign exchange trading. It is determined by the overnight interest rate and is a differential between two involved currencies and affected whether the position is a buy ‘long’ or sell ‘short’.

- Eightcap Fees are ranked good with overall rating 8 out of 10 based on our testing and compared to over 500 other brokers. Overal fees are good, some deposits and withdrawals are free, but we recommend checking entity rules

| Fees | Eightcap Fees | FXTM Fees | Fortrade Fees |

|---|---|---|---|

| Deposit Fee | No | No | No |

| Withdrawal Fee | No | No | No |

| Inactivity Fee | No | Yes | Yes |

| Fee ranking | Low | Average | High |

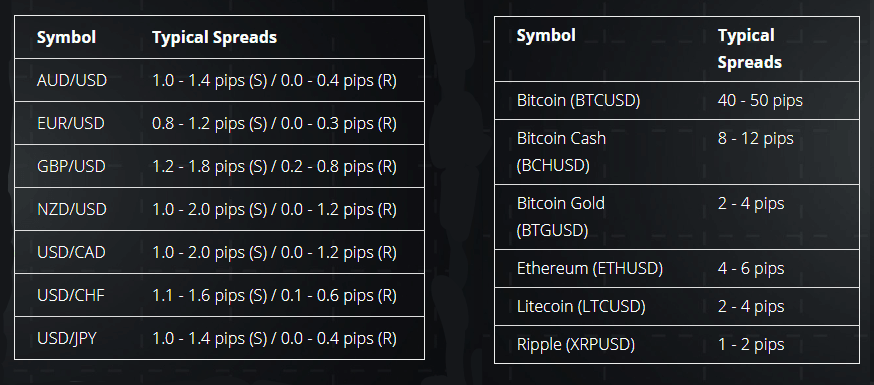

Spreads

EightCap spreads are designed for the account you use, while Standard account offers slightly higher spreads with no commissions and Raw account allows enjoying interbank spread but with commission per trade.

As we found, EightCap brings nice costs with the typical spread for EUR/USD standard 0.8-1.2 pips and raw spread of 0.0-0.3 pips, or with a spread for metals XAU/USD 20-30 cents.

For instance see below a comparison of the spread offering, as well you may compare EightCap fees to another popular broker FBS.

- Eightcap Spreads are ranked average with overall rating 9 out of 10 based on our testing comparison to other brokers. Broker indeed brings excellent costs with the typical spread for EUR/USD at a standard 1.0 pips, as well as a raw spread of 0.0 pips. The spread for metals XAU/USD sits at 1.0 pips.

| Asset | Eightcap Spread | FXTM Spread | Fortrade Spread |

|---|---|---|---|

| EUR USD Spread | 0.8 pips | 1.5 pips | 2 pips |

| Crude Oil WTI Spread | 4 pips | 9 pips | 4 pips |

| Gold Spread | 4 pips | 9 | 45 |

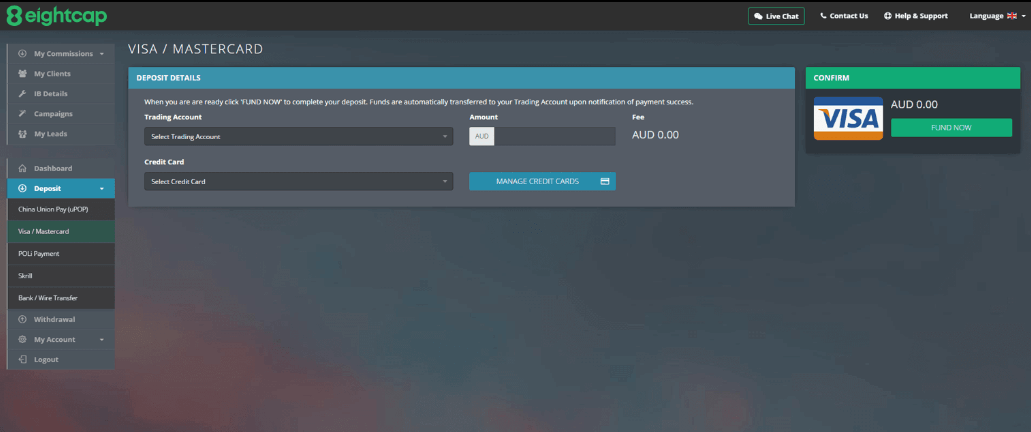

Payment Methods

The number of payment methods to fund the trading account which allows you to transfer from Demo trading to Live one including instant deposits through Visa/MasterCard, Skrill, Neteller, China UnionPay and Bank Wire Transfers.

- EightCap Funding Methods we ranked Good with overall rating 9 out of 10. The Minimum deposit is $100. Besides, international trading supports numerous methods with low fees, while the European is rather modest offering only the most used and regulated ones, but still conditions are good in our opinion.

- Eightcap clients can now make Crypto deposit via BTC and USDT on USD accounts only.

- While you may choose at your convenience a base account currency either AUD, USD, GBP, EUR, NZD, CAD and SGD, the deposits and withdrawals will be respectively made in the same currency as the base of trading account.

Here are some good and negative points for EightCap funding methods found:

| Eightcap Advantage | Eightcap Disadvantage |

|---|---|

| Various Deposit and Withdrawal methods supported | Methods vary according to entity |

| Multiple Account Base Currencies | Withdrawal fee may be applicable due to regional laws |

| PayPal Deposit and Crypto Deposits accepted | |

| Withdrawal requests processed quickly |

EightCap Minimum deposit

Minimum deposit is 100$ at EightCap for both account types offered. Also, EightCap does not charge any internal fees for deposits or withdrawals, yet you should note that payments from non-Australia banks may be subject to bank fees and is solely your responsibility.

EightCap minimum deposit vs other brokers

| EightCap | Most Other Brokers | |

| Minimum Deposit | $100 | $500 |

Withdrawals

EightCap withdrawal options including bank transfer, debit cards and ewallets. There is no fee for deposits and withdrawals, meaning you can easily manage fundings, yet make sure to deposit in your account base currency to avoid conversion. See Card Depositt comparison below:

Trading Platforms

With Eightcap, the trader will have access to MetaTrader 4 and the newer MT5 platform, which has numerous advanced features and tools. Also, Traders now have an access to TradingView, which enables traders to set up a multi-monitor workspace.

Scores & Availability of different platforms

- Eightcap Platform is ranked Good with overall rating 9 out of 10 compared to over 500 other brokers. We admit good selection with popular MT4, MT5 also its own platform included, while software is user friendly and there is no restrictions on strategies.

| Platforms | EightCap Platforms | InstaForex Platforms | eToro Platform |

|---|---|---|---|

| MT4 | Yes | Yes | No |

| MT5 | Yes | Yes | No |

| TradingView | Yes | No | No |

| Own Platform | Yes | Yes | Yes |

| Mobile App | Yes | Yes | Yes |

Desktop Platform

The proprietary developed platform is available for desktop and mobile apps with the same capabilities to view prices in real-time, monitor or access an account, and enable chat and push notifications.

- What we found as great, MT4 provides all the necessary tools and resources that are essential for successful trading, with a range of indicators, and strategies to use.

- Furthermore, Eightcap users will also have the ability to automate their trades without any coding knowledge. With the use of capitalise.ai Eightcap users will have access to automation and analytic tools, including backtesting, loop strategies, smart notifications, and much more.

- Regardless of the account type, all traders will have the same professional conditions to trade, as well as support from the company for any requirement.

Customer Support

EightCap provides 24/5 customer service available via various service centers and various methods inlcuding Live Chat and Emails, also we found team quite responsive.

- Customer Support in EightCap we rank Good with overall rating 8 out of 10 based on our testing. We found customer team responsive, also supporting various languages

See our find and Ranking of EightCap Customer Service Quality:

| Pros | Cons |

|---|---|

| Availability of Live Chat, Email and International Phone Lines | No 24/7 support |

| Quick response | |

| Relevant Answers |

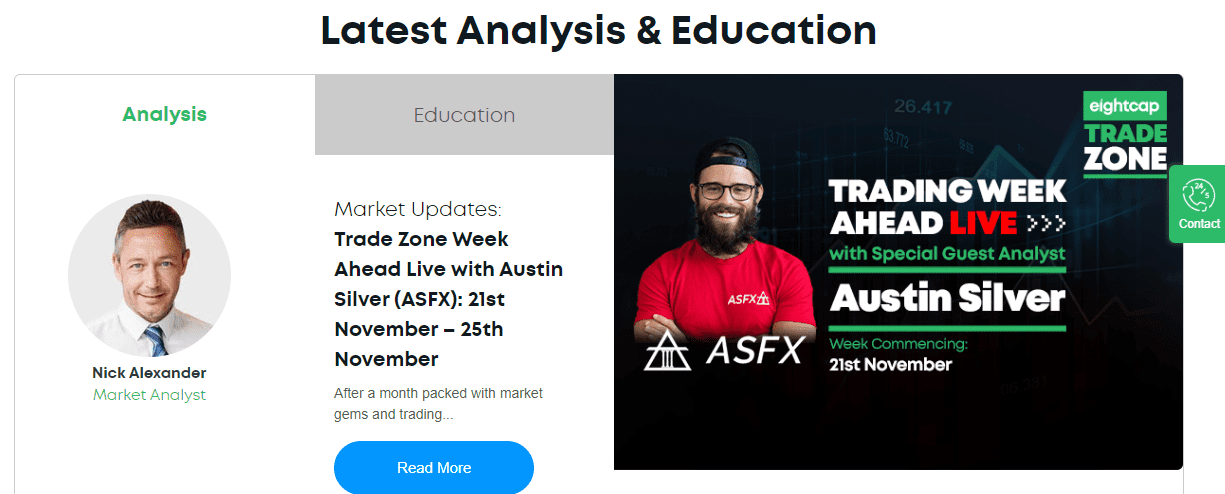

Education

Based on our finds Eightcap provides some education but mainly analysis and quite good research tools. For education itself it is limited to platform guides and overview of strategies, while research is good with numerous tools included.

- Eightcap Education ranked with overall rating 7 out of 10 based on our findings, so compared to other brokers education is limited and does not include good Trading Academy like other brokers have, which is more suitable for beginning traders so. However, research is good at Eighcap

EightCap Review Conclusion

EighCap stands as a trusted and regulated trading service provider with good business model built on simple trading without making choices complicated or confusing, yet providing good conditions. Their main offering is the technological solution of execution trough powerful servers with centralized integration, we found competitive pricing provided by leading institutions and access through the powerful features of popular platform MT4 along with accounts suited for various strategies.

While the only gap is deep learning materials which company does not provide, however, their support centers are showing great performance also Analysis is quite professional one.

Based on Our findings and Financial Expert Opinion EightCap is Good for:

- Forex Traders

- Traders who prefer MT4 or MT5 platform

- EAs running

- Long Term Trading

- Raw Spread Trading

- Trading Analysis

- Traders with Variety of Trading Strategies