BDSwiss Review

- Leverage: 1:500

- Regulation: FSC, FSA

- Min. Deposit: 100 US$

- HQ:

- Platforms: MT4, MT5, BDSwiss Webtrader and App

- Found in: 2012

BDSwiss Licenses

- BDS Markets -authorized by the FSC (Mauritius) registration no. C116016172

- BDS Ltd – authorized by FSA (Seychelles) registration no. SD047

See also: An Honest Eightcap Review for Traders: Unlocking the Benefits

What is BDSwiss?

BDSwiss review is an international Forex Broker and a brokerage firm established in 2012, which fastly approached Markets and became one of the largest trading groups, and now serves as one of the leaders. The current clients’ base of BDSwiss counts more than a 1.5 million registered clients from over 186 countries, as well as serving exclusive Member club that has more than 1.5 million traders.

Since the approach of the company establishment comes from Switzerland, it has strong basis of the environment, also providing online trading services as a worldwide operating group with established offices in various regions Kuala Lumpur – Malaysia, Tirana – Albania, Pristina – Kosovo. See more details in our BDSwiss Review and summary section.

BDSwiss Pros and Cons

BDSwiss has a good reputation with long history of operation, which is a plus, and user-friendly trading conditions, there is a good choice between trading platforms, account opening is fast and customer service is great quality with education and research tools suitable for beginners or to advance trading knowledge.

On the other hand, we notice BDSwiss trading proposal depends on the entity and instruments are limited to Forex and CFDs, so is worth reconsidering in case proposal is suitable for you, besides for now Broker operates via its International entities only.

| Advantages | Disadvantages |

|---|---|

| Worldwide coverage through entities in Mauritius, Seychelles | Support not available 24/7 |

| Wide Forex and CFD instruments | Operating via International Entities |

| Powerful trading technology | |

| Choice between MT4, MT5, Mobile App and Proprietary platform | |

| Fast account opening | |

| Suitable for Beginners and Professionals | |

| Quality customer support |

BDSwiss Review Summary in 10 Points

| Regulation | FSC, FSA |

| Platforms | MT4, MT5, BDSwiss Webtrader and Mobile App |

| Instruments | Commodities, Forex, Metals, Indices, Cryptocurrencies |

| EUR/USD Spread | 1.5 pips |

| Demo Account | Available |

| Minimum deposit | $100 |

| Base currencies | USD, EUR, GBP |

| Education | Learning Academy with Forex Courses |

| Customer Support | 24/5 |

Overall BDSwiss Ranking

Based on our review and Expert Opinion in Forex Trading, BDSwiss is a trustable broker with good reputation for years of its operation and quality trading conditions, also with a good technical trading offering. However, there are some gaps due to operation via International branches only.

- BDSwiss Overall Ranking is 9 out of 10 based on our testing and compared to 500 other brokers, see Our Ranking below compared to other popular and industry Leading Brokers.

Awards

BDSwiss in fact earned not only good reviews from world trading community but also numerous industry awards for its successful operation and trading technology they heavily invest in. We saw before BDSwiss establishment, and not few only few years it is one of the largest proposals, while BDSwiss was rewarded for its excellent service and trading technology and also recognized for its Trading App along with Trade Execution, here are some of the awards:

- BEST MOBILE TRADING PLATFORM EUROPE Global Banking & Finance Awards

- BEST FX RESEARCH & EDUCATION PROVIDER World Finance Awards

- BEST MARKET RESEARCH PROVIDER FxScouts Awards

Is BDSwiss safe or a scam?

No BDSwiss is not a scam, it is a broker with long years of operation and good reputation of operation.

Is BDSwiss UK Regulated broker?

BDSwiss operation offices located in offshore zones Mauritius and Seychelles, which is registered by the Mauritius Financial Services Commission (FSC) and all in all enhance the broker’s possibility to offer its service to various residents globally. So we found and Review BDSwiss is not UK Regulated.

However, as we always recommend check on the regulation carefully and never sign in with only offshore registered brokers

How are you protected?

According to the Broker, the security of funds along with client protection delivered in multiple ways that ensure a safe trading environment and investors’ legal compliance including segregation of funds and participation to some customer protection organizations. However, we would advise to double-check security layers too if it is suitable for you personally.

See our conclusion on BDSwiss Reliability:

- Our Ranked BDSwiss Trust Score is 7 out 0f 10 for good reputation and years off its successful operation, yet the gaps are top-tier regulations with compensation schemes and other protective measures. Yet, in case of BDSwiss since company has many years of establishment and a good reputation so it is worth considering in our opinion.

See our conclusion on BDSwiss Reliability:

| BDSwiss Strong points | BDSwiss Weak points |

|---|---|

| Regulated international broker | Not listed on Stock Exchange |

| Global coverage | Runs offshore entities in Mauritius and Seychelles |

| Good reputation and long years of operation | |

| Negative Balance Protection applied |

What Leverage does BDSwiss offer?

Leverage, known as a loan given by the broker to the trader enables you to trade through the multiplied volume that may raise your potential gains, yet in reverse increases high risks too. So firstly you should learn how to use tools smartly, also various regulatory standards and restrictions set a particular allowed level of leverage that is considered to be safe.

- BDSwiss offers traders option to use higher leverage, enabling to gain a much larger exposure with relatively little capital. BDSwiss clients under the FSA and FSC regulation can trade with a maximum leverage of 1:1000.

Yet, for the most accurate data check on the official BDSwiss platform and verify its allowance with your residual status, also make sure to check each instrument separately as it varies according to the asset as well besides to using precisely reasonable levels to keep you risks law, see examples below.

BDSwiss Account types

BDSwiss offers three account types which are Classic, Vip and Raw, created to cater to the needs of different Forex traders with either lower costs according to trading sizes or advanced services once size increases. While Classic and Vip account are based on the spread-only model, Raw account features interbank spreads and commission charge per lot, which gives good flexibility to choose accountn you would need the most, see account comparison snapshot below.

| Pros | Cons |

|---|---|

| Fast account opening | None |

| 4 Account types are offered | |

| Selection between three base currencies | |

| Demo Account and Live Account | |

| Daily Analysis and Exclusive Webinars for VIP clients |

- Under its FSC regulated entity BDS Markets, BDSwiss also offers Premium account.

- Also, we found one more account – StockPlus Account, available only under FSC entity. BDSwiss’ StockPlus account enables BDSwiss clients to build a diversified portfolio with over 1000+ world-leading stocks and ETFs. The account features 0% commissions for unleveraged investing in stocks and the option to use up to 1:5 leverage to trade stocks and ETFs at DMA.

When opening your trading account there is an option to choose the desired base currency through the selection between the Euro (€), US Dollar ($) and the British Pound (£), which is definitely great as it means you will not be charged for currency conversion, while the account balance can’t fall below zero due to the applied negative balance protection.

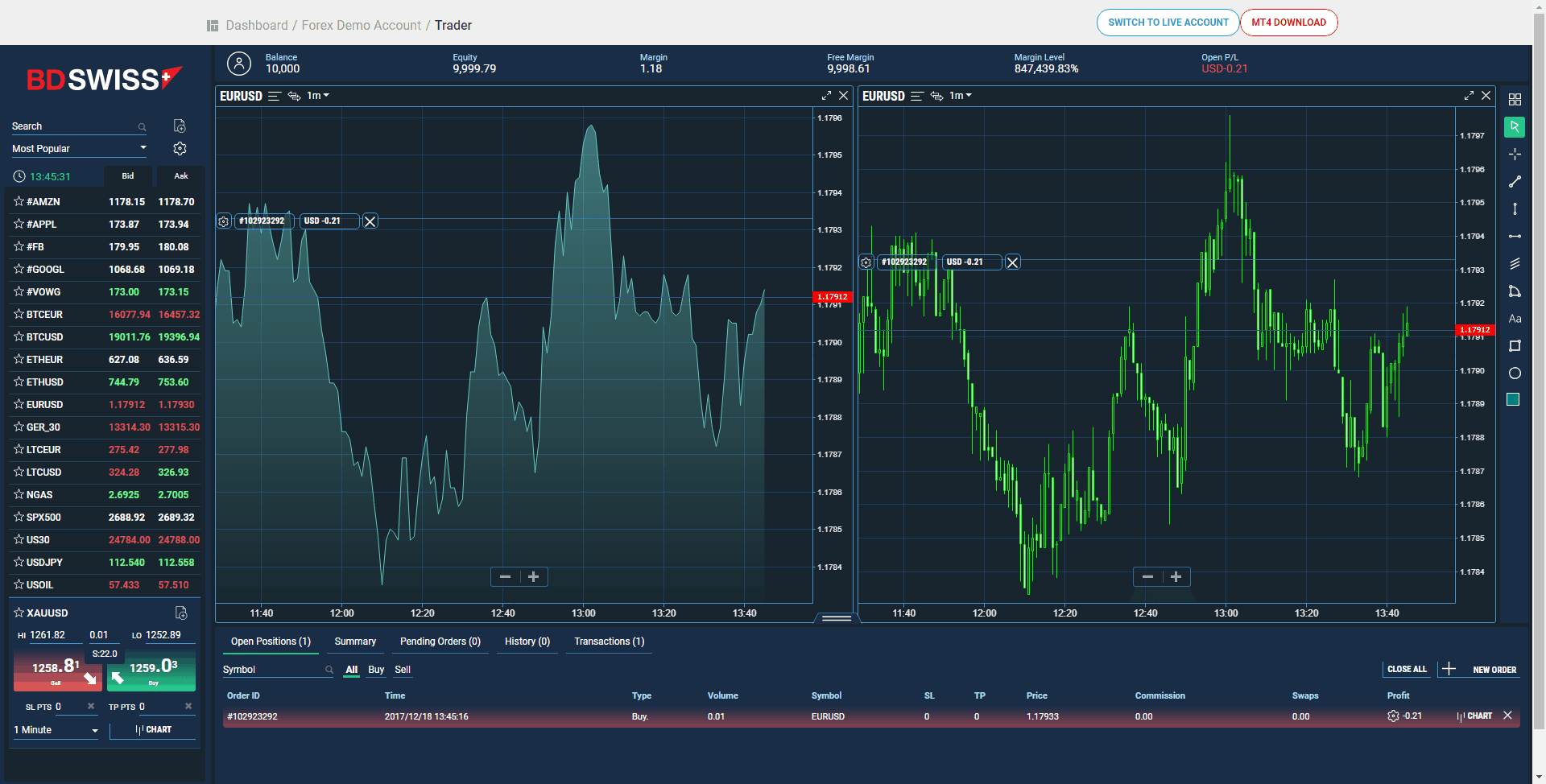

Demo Account

BDSwiss also offers a Forex or CFD “Demo Account” and gives new traders the opportunity to put their skills to the test on free Demo accounts with adjustable virtual balances of up to 1,000,000€/$/£. BDSwiss clients can open any type of account offered by BDSwiss including Classic, Raw, VIP, Premium (under FSC only) and Cent (underFSC only) as a Demo Account and test the tools, conditions and spreads offered, which is definitely a big plus.

How to open Trading Account?

- Load BDSwiss Sign In page.

- Enter your personal data (Name, email, phone number, etc)

- Upload your documents to verify the account. It is a legal procedure to check proof of your residents, through utility bill, your ID or similar.

- Complete questioner about your trading experience and expectations

- Once your account is activated you will get access to your account area.

- Next, once you learn all risks and benefits involved, you may proceed with funding.

- Almost instantly you will be able to start trading through BDSwiss platforms.

Fees

BDSwiss trading fees are mainly based on as spreads, for each underlying asset you will be charged for we will find the usual applicable spread, while the rollover for short and long positions is also an additional charge if you held positions overnight, as well as the margin requirement. Full BDSwiss pricing including funding fees and Administration fee for non-use account, see the table below on our finds.

- BDSwiss Fees are ranked average, low with overall rating 8 out of 10 based on our testing and compared to over 500 other brokers. Fees might be different based on entity, also majority of currency pairs are on an average level for spreads, additional fees like funding fees, rollover

| Fees | BDSwiss Fees | AvaTrade Fees | Plus500 Fees |

|---|---|---|---|

| Deposit Fee | No | No | No |

| Withdrawal Fee | No | No | No |

| Inactivity Fee | Yes | Yes | Yes |

| Fee ranking | Average | Average | Low |

Does BDSwiss have inactivity fee?

In case account remain inactive over 6 months Broker may charge an inactivity fee, check conditions based on each entity.

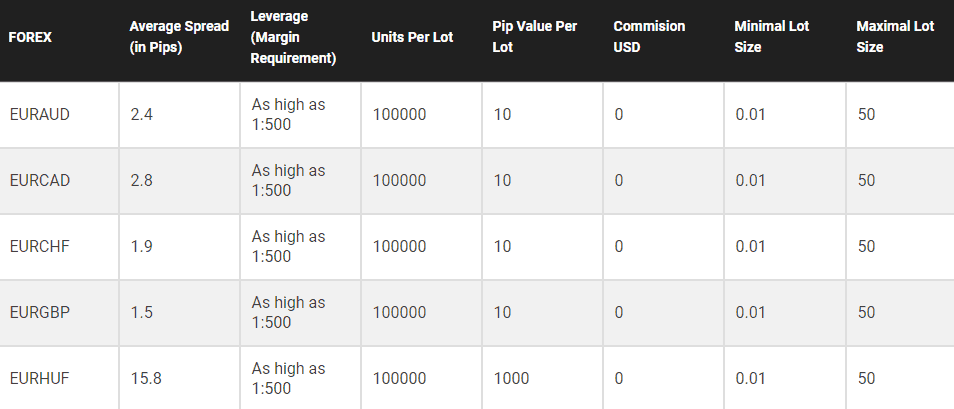

BDSwiss Spreads

BDSwiss Classic and VIP account fees are all included in the spread spreads and commissions charged when conducting trade and vary according to the account type you select. If you are a trader of bigger size and prefer commission basis then Raw Account is your choice. The Raw account offers an interbank spread averaging 0.3 for EURUSD and commission paid per transaction opening which is 5$.

To get a closer look, check below the comparison of most popular assets applicable to the BDSwiss Classic Account type, while the broker himself mentions that Classis spread are starting from 1.5 pips and VIP feature lower conditions with a spread from 1.1 pip. Also, you may compare BDSwiss fees to its peer BlackBull markets and other popular brokers listed below.

- BDSwiss Spreads are ranked average with overall rating 8 out of 10 based on our testing comparison to other brokers. We found Forex spread on industry average for standard account, and conditions might be better for commission based account, compared to other brokers in industry

Asset/ PairBDSwiss SpreadAvaTrade SpreadPlus500 SpreadEUR USD Spread1.5 pips1.3 pips0.6 pipsCrude Oil WTI Spread632Gold Spread254029BTC/USD Spread20000.75%0.35%

Snapshot of Real BDSwiss spreads

Trading Instruments

BDSwiss provides access to trade a great range of 1000+ underlying assets, while you may choose from Indices, Forex, Commodities and Cryptocurrencies based on CFDs, or Options Trading. However, range of instruments depends on the account type or BDSwiss entity you use.

Therefore, with access to most liquid and popular markets you may choose the desired and most understanding instrument according to your trading need and use BDSwiss portal to make this choices, which we should admit as user-friendly.

- BDSwiss Instrument Selection Score is 8 out 0f 10 for good trading instrument selection, yet selection of instrument might be different based on the platform you use or entity of BDSwiss you sign with

Can I trade Cryptocurrencies?

Yes, you can trade Cryptocurrencies based on CFDs as presented on the BDSwiss proposal, besides we found quite good costs and spreads for Crypto Trading too. See snaphot on our finds on available Markets:

Funding Methods

BDSwiss works with a variety of payment service providers that covers a wide range of deposit methods in a particular country.

BDSwiss clients can choose preferred deposit method right before funding trading accounts and enjoy $0 fees on all deposits. BDSwiss accepts introductory deposits, and processes withdrawals, in the form of instant transfers, bank transfers or credit card transactions, however note – with outgoing credit card payments typically take between two to seven business days to process.

- BDSwiss Deposits and Withdrawals we ranked Excellent with overall rating 10 out of 10. Minimum deposit is low, also Fee condtions are good either with no fees or very small based on thhe funding method you use, besides range of methods is very wide

Here are some good and negative points on BDSwiss Deposits and Withdrawals found:

| Pros | Cons |

|---|---|

| Fast account opening | None |

| 4 Account types are offered | |

| Selection between three base currencies | |

| Demo Account and Live Account | |

| Daily Analysis and Exclusive Webinars for VIP clients |

Deposit methods

The methods including a wide range of payment options yet may vary according to the country regulations and your residence so always good to verify this information with the support center as well.

- credit cards

- bank transfers

- Sofortüberweisung

- Skrill, iDEal, EPS, giropay, and many more

BDSwiss Minimum deposit

BDSwiss minimum deposit is 100$ for Classic account, which is an attractive opportunity to many traders for a Classic account. Also, BDSwiss does not charge any fees on credit card/electronic wallet deposits as well.

BDSwiss minimum deposit vs other brokers

| BDSwiss | Most Other Brokers | |

| Minimum Deposit | $100 | $500 |

Withdrawals

BDSwiss arranges withdrawal options with good range of supported payment methods, while the minimum withdrawal amount is $100, in most cases the withdrawals processed free of charge. Yet in case you would like to withdraw less than the mentioned amount the broker may add on a fixed processing fee of 10$.

How long does it take to withdraw money from BDSwiss?

As the broker mentions it always aims to give withdrawal service within 24 hours, yet this is applicable towards working business days, as on weekends or holidays it may take longer to proceed. As well, always give additional days for your payment to proceed with the transaction once it is already confirmed and done by BDSwiss, while we got withdrawal pretty quickly.

How do I withdraw money from BDSwiss?

You should login to your Client Portal and submit a withdrawal request by following of the required procedure. You can check the exact steps by following this link.

Trading Platforms

The software solution offered by the BDSwiss mainstays at the popular choice of MetaTrader4 platform, which provides a comprehensive trading feature and vast of solutions. MT4 is a known industry intuitive platform, even though might be with little outdated layouts, still is widely used platform.

Besides, Traders will definitely enjoy numerous add-ons as we did, that are available on the market to make trading process a pleasant one. Moreover, there are plenty of strategies to choose from since broker does not impose strict restrictions, so news trading or other strategies are available.

The available platform versions suited to various devices so traders can us any device, which is a good plus. This includes PC, Mac, Applications or Web platform that requires no installations. See some of our finds for benefits and disadvantages of the platform below.

- BDSwiss Platform are ranked Excellent with an overall rating 10 out of 10 compared to over 500 other brokers. The high ranking is deserved with good range of platforms including popular MT4 and MT5, also developed its own platform with good research and tools

Trading Platform Comparison to Other Brokers

| Platforms | BDSwiss | AvaTrade | Plus500 |

|---|---|---|---|

| MT4 | Yes | Yes | No |

| MT5 | Yes | Yes | No |

| Own Platform | Yes | Yes | Yes |

| Mobile Apps | Yes | Yes | Yes |

Web Trading

Proprietary BDSwiss WebTrader is fully based online, so you don’t need any downloads or installation and may access trading right from your browser. The platform has a clean view and quite comprehensive and powerful analysis features including technical analysis and risk management tools. So even by the use of WebTrader you can make full out of trading, see trading snapshot below.

Desktop Platform

The available versions of both MetaTrader4 and MetaTrader5 suited to various devices and including PC, Mac, Applications or Web platform that requires no installations. Yet you can download the desktop version for those platforms and use its full capability, which is more required by active or professional traders.

MT5 being a newer version also gained great popularity and features even more developed tools and comprehensive analysis options, loved either by beginners or professionals. Moreover, there are plenty of strategies to choose from, that are useful for every trader, novice or experienced either with manual trading or automated trading through EAs.

Mobile Trading Platform

Of course, BDSwiss developed its Mobile App as well, which actually is highly rewarded by traders and publications. All the most important features are available there, so being on the go you still may perform analysis, check on the open positions, manage them and access your account management, which deserves good regard from us too.

BDSwiss Customer Support

One of the other great points we should admit is Customer Support. BDSwiss multilingual support is available with service the trader requires daily which is also on a very sustainable and professional level. Even though you can Live Chat, Phone or Email them within working hours 24/5 we still remain happy with its quality level.

- Customer Support in XM is ranked Good with overall rating 8 out of 10 based on our testing. Support is knowledgeable, fast answers are received on Live Chat, also quite easy to reach during the working days

Education

By maintaining optimum support and assistance, BDSwiss also educates its clients through its Trading Academy. Educational resources covering useful information on how to operate in markets, develop own trading strategy with accredited courses and webinars, we found it quite hahndy and very well organized making them suitable for beginners.

- Inn BDSwiss youu will find educational materials provided by Forex Courses, defined by the level of expertise, Webinars and Seminars.

- There are good Daily Webinars provided, which is a great option for all traders (especially for beginners to expand their Forex knowledge. You will also access useful information with market alerts, trading information and analysis through Research & Analysis Section, which is definitely good and necessary for any trader especially beginners.

In addition, the company runs an active blog and community of traders, which allows sharing the experience to get better knowledge about the markets and trading itself.

See our Conclusion of Research and Education Service Quality

- BDSwiss Education ranked with rating 9 out of 10 based on our Expert research. BDSwiss provides outstanding Education Materials, with quality research, constant webinars and quality materials covering various topics, also its Trading Academy is good organized

| Pros | Cons |

|---|---|

| Deep research tools | Comprehensive Research available for VIP and Raw account holders only |

| Economic Calendar, Market Analysis | |

| Autochartist and Price Alerts | |

| Performance Statistics and Fee Reports | |

| Daily Analysis and Exclusive Webinars for VIP clients |

Research

BDSwiss offers great research tools and supports traders with unique materials making you a better trader. Besides to general and popular tools alike Economic Calendars, quality market Analysis provided by BDSwiss Analyst team, there is also access to Authochartist and Trading Alerts available to all clients.

- In addition, BDSwiss offers all Trading Central and Autochartist market analysis tool. Where, Trading Central is a comprehensive suite of trading tools that offer traders the latest market insights created via a combination of AI indicators, automated pattern recognition, and analyst research.

- There is also another amazing and helpful tool that can be find in the BDSwiss Research Portal – Daily Market Analysis, which provides 24/5 market coverage and leading financial commentary through daily previews, video briefs and special reports.

However, the level of depth in research tool is depending on the client portfolio or account types, alike VIP and Raw account holders will benefit from deeper research materials including Exclusive Webinars, Performance Stats, VIP Trading Alerts and more.

BDSwiss Review Conclusion

An overall BDSwiss review concludes us a company that managed to increase client portfolio to over a million customers. There are stable trading conditions, proven along time, also what we saw along the history of BDSwwiss development, with a global proposal suited to worldwide clients, the range of accounts and education provided is good, research we would rank as outstanding, which is super big plus for any trader.

So BDSwiss might be a good match to various size traders, yet would be good to check all trading conditions and regulations and define if it is suitable for you, since for now BDSwiss operates only via International entities. Here you can also read our article about Islamic forex brokers.

Based on Our findings and Financial Expert Opinion BDSwiss is Good for:

- Beginning Traders

- Traders who use MT4 and MT5 platform

- Currency Trading and CFD Trading

- Traders looking for Good Research Tools

- Various of Trading Strategies

- High Leverage trading