Today, the US stock markets have reached new heights, crude oil has recovered from its initial weakness and gold, a refuge value, has been down. The risks weighing on global supplies due to tensions and violence in the Middle East continue to support oil in its drops. But we are also in a feeling of positive risk, with three major American indices all penetrating today in new unexplored territories while the rally fueled by technology continues.

- Gold analysis: metals start slowly a busy week

- Boj, ECB and American GDP among macroeconomic protruding facts

- The technical analysis of gold suggests that yellow metal is at the crossroads

The positive feeling of risk on equity markets also helps stimulate appetite for other risks at risk, including crude oil, but discourages investors with regard to gold, which nevertheless remains on track to potentially gain ground once the aggressive reassessment of the rate reductions in the federal reserve finished.

Gold starts slowly a busy week

Despite a recovery in the last two days of last week, gold has finished the decline in the week. It is still in red for January and therefore for the year. Its low performance contrasts strongly with the end of last year, with a triplet of monthly gains in the fourth quarter. Investors expected the Fed to reduce its interest rates earlier than expected. This year, these expectations were postponed thanks to solid data and the feet of the Fed, and the gold has therefore slightly fell as yields increased. A few weeks ago, everyone thought that a drop in rates in March was a certainty. Now it’s a draw, according to the Fedwatch tool of the CME.

The rate reductions expected by the Fed were postponed due to solid data and firm speeches on the part of the Fed against the expectations of a major accommodating orientation. Surprisingly, that did not prevent actions from achieving new heights, especially in the technological sector. Obviously, other factors come into play. But it suggests that gold could also regain its balance, especially since it has not lost too much ground.

So there is a good chance that we can see the upward trend of gold straightening once the expectations of reducing the Fed levels are stabilized. But I don’t take the lead. I will wait for the graphics to give a solid bullish signal before considering long configurations, especially when the central bank officials postpone the rate reductions.

Gold analysis: what are traders to concentrate this week?

The foreign exchange markets, gold and investors in equity will expect increased volatility this week due to some central banking meetings, namely the Bank of Japan and the European Central Bank, and certain first -rate data from the United States.

BOJ decision on interest rates

It is unlikely that the Bank of Japan (BOJ) modified its policy at this meeting, but it could do it at a given time during the first half. Recent data publications from Japan will encourage them very little to modify the current parameters, inflation data and age, both weak. If the Boj is even more conciliatory than expected, this could provide some support for gold, while any concrete signal indicating that it will end the negative interest rates would probably have a negative impact on the price of the As the yield of Japanese state bonds increases.

Manufacturing PMI indices

The global PMI indices on Wednesday will give us an overview of the world economy situation at the start of the year. Traders could use them as a demand indicator for various products. The concerns about Chinese and European economies have slowed down raw materials and clues highly focused on raw materials, such as FTSE 100 and China A50. On the other hand, the technology -oriented clues, such as the Nasdaq 100, has behaved well, betting that the global slowdown will lead to significant interest rates. The basic metals, whose copper, have experienced difficulties, affecting silver and, to a lesser extent, gold. Let’s see what purchasing directors in the manufacturing industry and services report for the start of the year. PMIs are considered to be advanced indicators and have more weight for investors. A positive response of risk assets could stimulate foreign currency compared to the US dollar, thus providing gold support.

ECB Rate Decision

The next European Central Bank (ECB )’s decision on rates may have an impact on gold. If the ECB is more conciliatory than expected, this could lead to a decrease in European bond yields, thus providing support to assets such as gold and silver whose yields are low, even zero. However, the market is currently expecting a bellicist position on the part of the ECB, as indicated by several managers attempting to resist the first rate drops, like the Fed approach. Unlike the United States, where the decline is mainly due to a relatively higher economy, here it is more concerns about the persistence of inflation in the United Kingdom and in the euro zone, partly thanks to pressures high employees. The president of the European Central Bank, Christine Lagarde, alluded to a potential reduction in loan costs this summer rather than in the spring, echoing the concerns about the inflation of wages expressed by other officials of the ECB . Let’s see if the European Central Bank offers other indices at this meeting.

American GDP and PCE inflation

Gold, being an asset based on the US dollar, will probably be more affected by the next American data than anything else. Recent Robust reports on the IPC, employment and retail sales have stimulated the dollar, exerting pressure on gold prices. If GDP data show that the US economy remains strong, the expectations of an imminent reduction in interest rates will still be postponed. Gold lovers will be on the lookout for the weaknesses of American data, including the report on Thursday’s GDP and Core PCE data the next day.

Technical analysis of gold (XAU/USD)

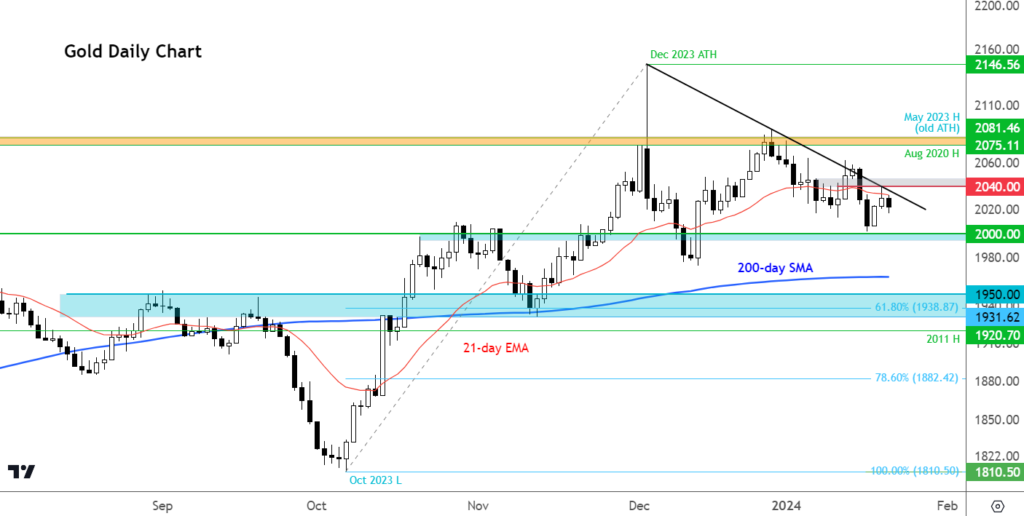

Gold is at the crossroads, and its short-term management will become clearer with either a breakthrough above the short-term lower trend line around the US $ 2040 mark (indicating an upward trend) , or a decisive drop below the crucial horizontal support at around 2,000 US $ (suggesting a lower movement).

Despite its recent difficulties, the overall trend remains upward if we neglect recent price movements. Since reached $ 1,810 lower in October, gold has reached several lower and some higher, including a new record in December. The metal exceeded its mobile average over 200 days in mid-October and maintained its position above.

A successful break in the short-term downward trend line could trigger new technical purchases, with a target set over the fork from 2040 to 2045 US dollars. The recent summit of about $ 2,062 becomes a key goal for upward transactions. A possible exceeding this level could lead to a rally to the next resistance zone between US $ 2075 and US $ 2080. Beyond that, there is no significant reference point up to the December summit at 2146 US $.

On the other hand, a net break of the support around US $ 2,000 could lead to a return to the mobile average of 200 days at US $ 1964. If the price falls below the 200 -day mobile average, the next potential support area is between US $ 1930 and US $ 1950, where the Fibonacci retrace of 61.8% aligns on the support levels and of previous resistance, which makes it a crucial area to defend for the bullish.