Forex tools encompass a variety of resources, software, and instruments that traders use to facilitate and enhance their activities in the foreign exchange (forex) market. These tools can assist with analysis, execution, risk management, and decision-making. Here are some common types of forex tools:

Trading Platforms:

MetaTrader 4 (MT4) and MetaTrader 5 (MT5): These are widely used trading platforms that provide charting, technical analysis tools, and order execution capabilities.

Charting Software:

TradingView, MetaTrader: These platforms offer advanced charting tools, technical indicators, and drawing capabilities to help traders analyze price movements and make informed decisions.

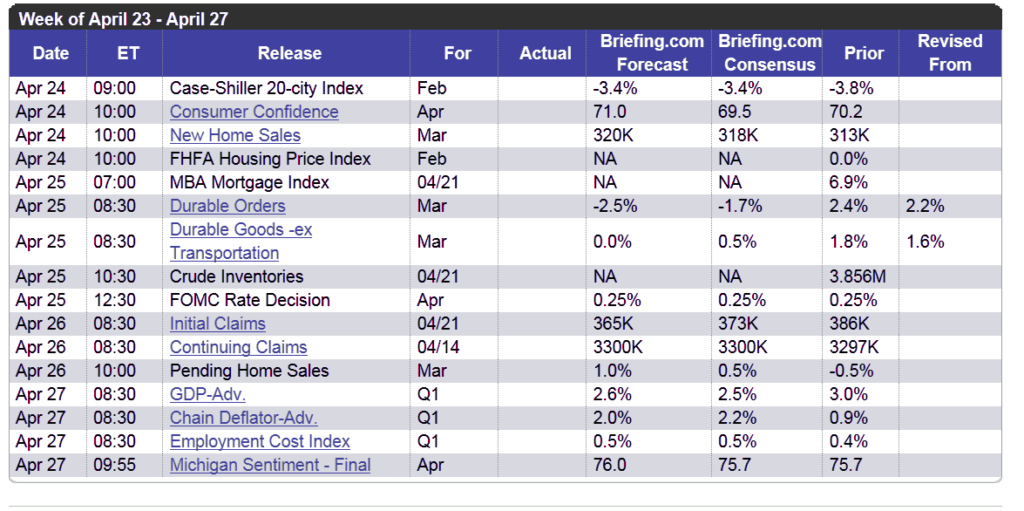

News and Economic Calendars:

ForexFactory, Investing.com, DailyFX: These websites provide economic calendars, news releases, and market analysis to help traders stay informed about events that can impact currency prices.

Algorithmic Trading (Expert Advisors):

Algorithmic trading platforms on MetaTrader: Traders can use automated trading strategies (Expert Advisors or EAs) to execute trades based on pre-defined rules and algorithms.

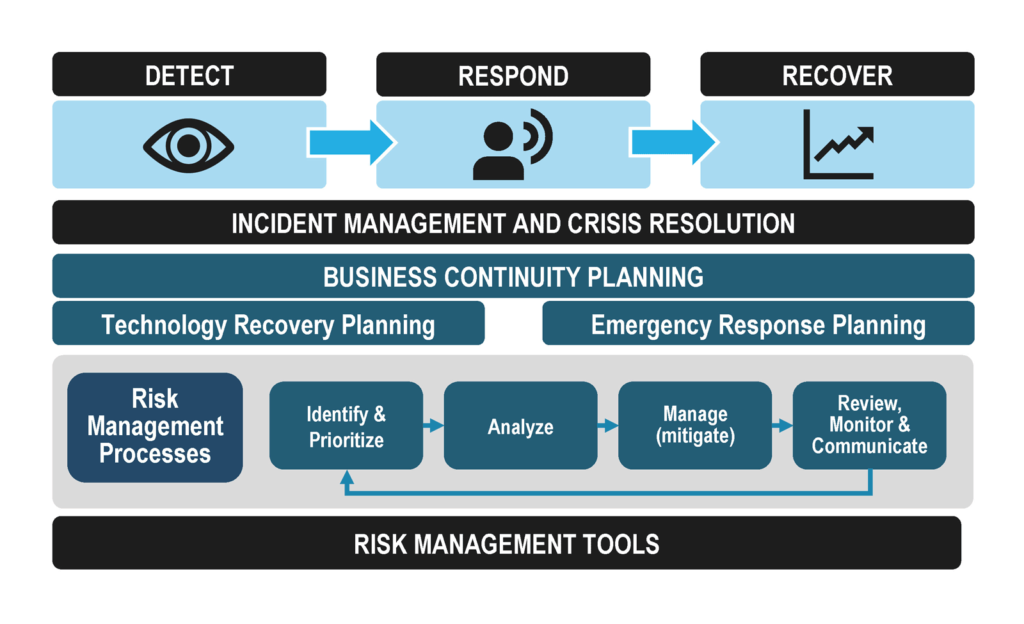

Risk Management Tools:

- Position Size Calculators: These tools help traders determine the appropriate position size based on their risk tolerance and the size of their trading capital.

- Stop Loss and Take Profit Orders: Integrated into trading platforms, these orders help manage risk by automatically closing trades at specified price levels.

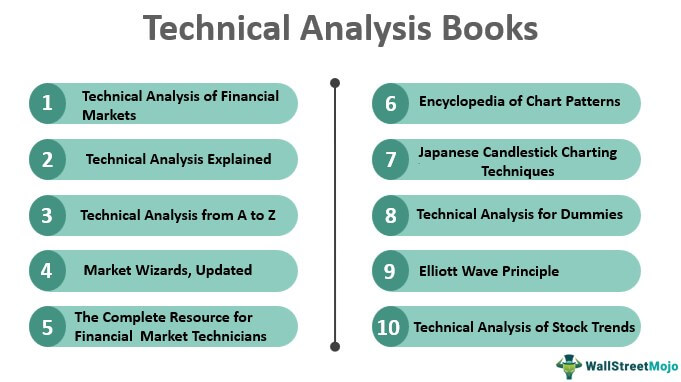

Technical Analysis Tools:

- Indicators and Oscillators: Tools such as Moving Averages, Relative Strength Index (RSI), and Fibonacci retracements are commonly used for technical analysis.

- Chart Patterns: Traders use patterns like triangles, head and shoulders, and double tops/bottoms to identify potential trend reversals or continuations.

Fundamental Analysis Tools:

- Economic Indicators: Tools that provide information on economic indicators, central bank decisions, and geopolitical events that can impact currency values.

Market Sentiment Indicators:

- Commitments of Traders (COT) Reports, Speculative Sentiment Index (SSI): These tools provide insights into the positioning of institutional and retail traders, helping to gauge market sentiment.

Forex Signals and Analysis Services:

- Signal Services: Traders can subscribe to signal providers who offer trade recommendations and analysis.

- Market Analysis Reports: Some platforms and websites provide in-depth analysis and insights into currency pairs and market trends.

Education and Training Resources:

- Online Courses, Webinars, Forums: Various educational resources help traders enhance their skills and stay updated on market developments.

Mobile Apps:

- Mobile Trading Apps: Many brokers offer mobile applications, allowing traders to monitor and execute trades on the go.

Backtesting Software:

- Forex Tester, TradingView Backtesting: Traders use these tools to test their trading strategies on historical data to assess their viability.

It’s important for traders to choose tools that align with their trading style, preferences, and goals. Additionally, understanding the limitations and risks associated with each tool is crucial for effective use in the forex market.