Proper risk management is crucial for success in forex trading. Here’s a step-by-step guide on how to use effective risk management in the forex market:

1. Determine Your Risk Tolerance:

Before you start trading, assess your risk tolerance. Understand how much you are willing to risk on a single trade and in total. This will help you establish guidelines for position sizes and overall exposure.

Define Your Position Size:

Calculate the position size based on the percentage of your trading capital that you are willing to risk on a single trade. A common rule of thumb is to risk no more than 1-2% of your total trading capital on any given trade.

Set Stop Loss Orders:

Always use stop loss orders to define the maximum amount you are willing to lose on a trade. Place your stop loss orders at a level that makes sense from a technical or fundamental analysis perspective. This order will automatically close your position if the market moves against you.

Diversify Your Trades

Avoid putting all your capital into one currency pair. Diversifying your trades across different assets can help spread risk. Each trade should be viewed as part of your overall portfolio.

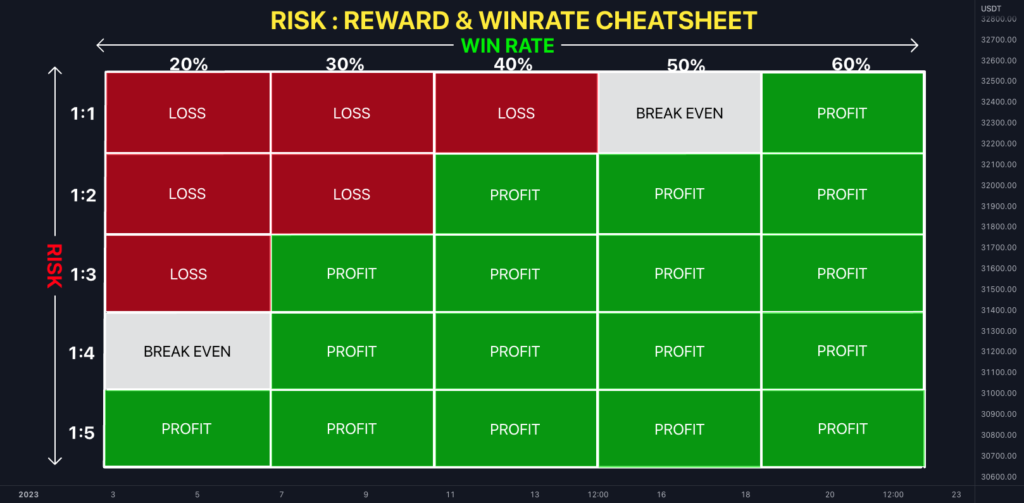

Use a Risk-Reward Ratio:

Determine your risk-reward ratio before entering a trade. This ratio compares the potential profit to the potential loss. A common guideline is to aim for a risk-reward ratio of 1:2 or better, meaning that your potential profit is at least twice the amount of your potential loss.

Consider Leverage Carefully:

While leverage can amplify returns, it also increases the risk. Use leverage cautiously and be aware of its impact on your position sizes and overall risk exposure. Consider lower leverage to reduce the risk of significant losses.

Regularly Review and Adjust:

Continuously monitor your trades and reassess your risk exposure. Market conditions can change, and adjustments to your risk management strategy may be necessary. Regularly review your trading plan and adapt it as needed.

Stay Informed about Market Conditions:

Stay informed about economic indicators, news events, and other factors that can impact the forex market. Being aware of potential market-moving events allows you to make informed decisions and adjust your risk management strategy accordingly.

Avoid Emotional Decision-Making:

Emotions can lead to impulsive decisions, often resulting in poor risk management. Stick to your predetermined risk parameters and trading plan. If a trade goes against you, avoid the temptation to deviate from your plan due to fear or greed.

Educate Yourself:

Continuously educate yourself about forex markets and trading strategies. The more you understand the factors influencing currency movements, the better equipped you’ll be to make informed decisions and manage risk effectively.

Conclusion:

By following these steps and maintaining discipline in your trading approach, you can implement proper risk management in forex and increase your chances of long-term success.