The EUR/USD pair sees some buying interest, bouncing off a two-week low recorded on Tuesday. Despite this recovery, there’s a cautious sentiment among traders ahead of the Federal Reserve’s decision.

The Fed is expected to maintain its historically high interest rates, possibly revising down its forecast for rate cuts in 2024 due to persistent inflation. Investors are closely monitoring the “dot plot” and statements from Fed Chair Jerome Powell for clues on future rate adjustments, which could influence the direction of the US Dollar and impact EUR/USD.

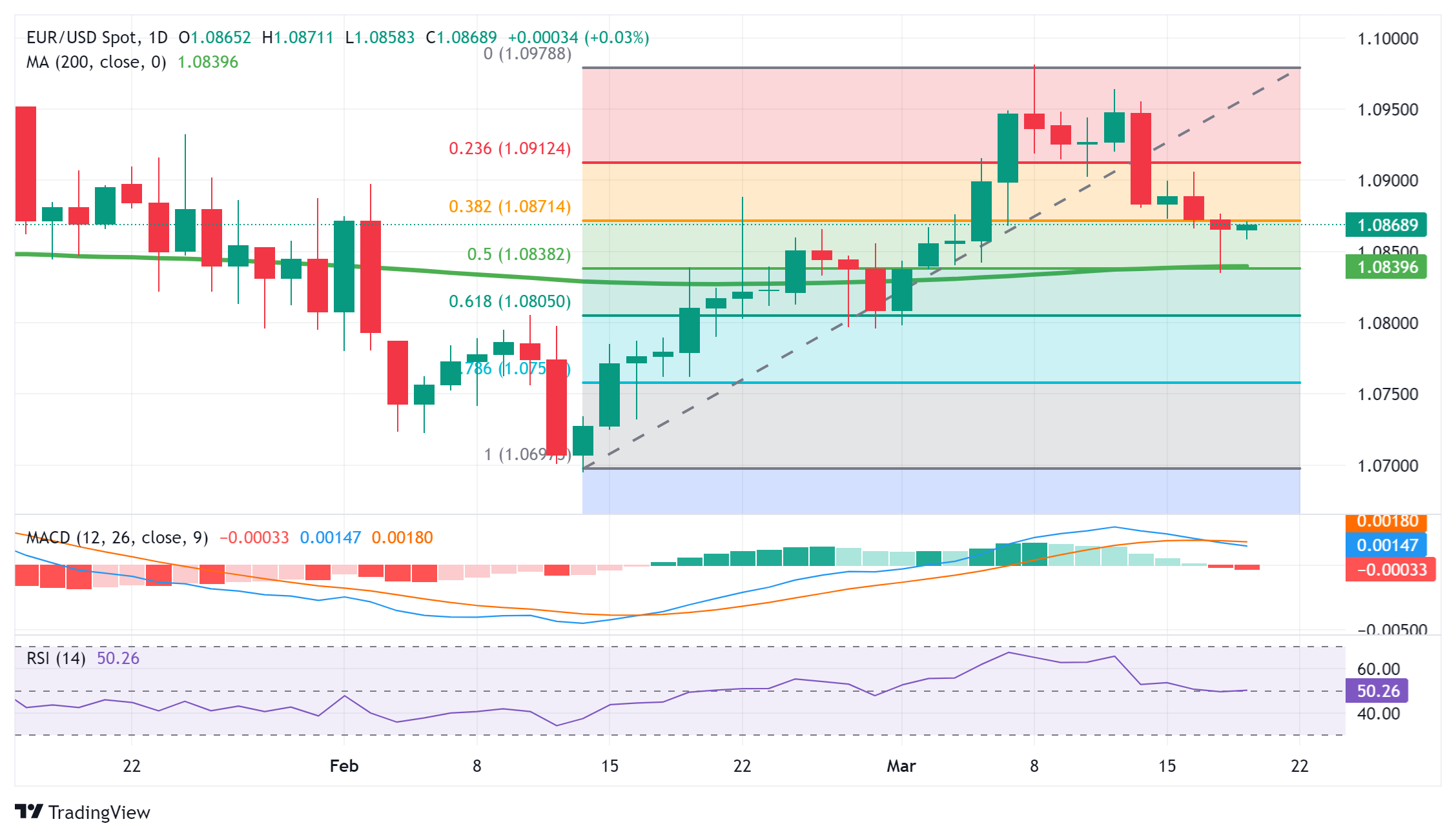

Technically, the recent retreat from the 1.0980 level found support near 1.0835, marked by the 200-day Simple Moving Average and the 50% Fibonacci retracement level. A decisive break below this support could signal further downside momentum, potentially targeting the 1.0800 psychological level and even testing lows below 1.0700.

Conversely, a move higher may encounter resistance near the 1.0900 level, followed by the 23.6% Fibonacci level. A sustained breakthrough could signal a reversal of the corrective pullback, with potential gains towards the monthly peak around 1.0980 and beyond.

EUR/USD daily chart