Pepperstone Review

- Leverage: 1:30 to 1:400

- Regulation: ASIC, FCA, DFSA, SCB, CMA, CySEC, BaFIN

- Min. Deposit: 200 US$

- HQ: Australia

- Platforms: MT4, MT5, cTrader, TradingView

- Found in: 2010

Pepperstone Licenses

- Pepperstone Limited – authorized by FCA (UK) registration no. 684312

- Pepperstone Group Limited – authorized by ASIC (Australia) registration no. ACN 147 055 703, AFSL 414530

- Pepperstone Markets Limited – authorized by SCB (Bahamas) License number SIA-F217

- Pepperstone Markets Kenya Limited – authorized by CMA Licence No.128

- Pepperstone EU Limited – authorized by CySEC (Cyprus) registration no. 388/20

- Pepperstone GmbH – authorized by BaFin (Germany) registration number 151148

- Pepperstone Financial Services (DIFC) Limited – authorized by DFSA (Dubai) license number F004356

Click here to read HYCM Review

Pepperstone review is a major and popular international Forex Broker that is a wholly-owned subsidiary of Pepperstone Group Limited, an Australian-based firm founded in 2010 that has swiftly risen to become one of the world’s leading Forex and CFD providers.

Furthermore, the broker is continually expanding its proposal and obtaining licenses. Pepperstone Limited was founded in the United Kingdom in 2015, with the goal of extending its services to meet the demands of UK and European customers via local access. Overall, the group has offices in key financial centers such as Melbourne, Dubai, Limassol, Nassau, Nairobi, Dusseldorf, and London.

Pepperstone is what kind of broker?

Pepperstone was formed as a professional forex broker offering interbank execution and low spread pricing. However, Pepperstone went on to provide support to both retail and institutional traders via low-cost pricing from various direct sources of liquidity, without a transaction desk, and as an execution-only broker.

Pros and Cons of Pepperstone

Pepperstone is a trustworthy broker with top-tier FCA and ASIC licenses, and the account opening process is completely digital, and the trading environment is one of the best recommended by us Australian providing with NDD accounts. There are sophisticated research and trading tools accessible, a wide selection of platforms, and an outstanding education department with prompt assistance.

In our perspective, there aren’t many cons. For example, demo accounts are only accessible for 30 days, and products are confined to Forex and CFDs. Aside from that, circumstances differ depending on the company and the appropriate regulatory norms.

| Advantages | Disadvantages |

|---|---|

| Multiply regulated broker with a strong establishment | Only Forex and CFDs |

| Good reputation | No 24/7 support |

| Wide range of trading platforms | Demo Account valid for 30 days |

| Global expand including Australia, Asia, MENA, Africa regions and Europe | Conditions vary based on entity |

| Great technical solution, tools. platforms | |

| Low Spreads | |

| Competitive trading conditions |

Awards

Since Pepperstone attempts to provide the greatest choices to the trading community, it has been acknowledged by various accolades, which the broker receives on a regular basis, as well as positive feedback from traders. Also, we see the broker evolving over time, as new instruments and higher quality tools are regularly introduced. Previously, Pepperstone was simply an Australia broker, but now it serves virtually the whole world, which is a huge bonus.

Is Pepperstone legit or a scam?

No, Pepperstone is not a scam; it is a well established Australian broker that operates in accordance with the acknowledged regulations of the Australian Securities and Investments Commission (ASIC), as well as the holder of an Australian Financial Services Licence, allowing for low-risk Forex trading.

Is Pepperstone genuine?

Pepperstone is a legitimate and registered broker. Furthermore, Pepperstone has necessary permission in each location where it works. As a result, customers residing in the United Kingdom and the European Economic Area are handled by Pepperstone Limited, a registered UK firm regulated by the Financial Conduct Authority.

- In addition, Pepperstone addiing on licenses constanly alike in 2020 acquire CySEC license as well, so that the EU clients are fully covered under its legislation. It also, add on BaFIN license at the end of the month securing German markets likewise. Read more on the News tag.

- MENA region and clients from Dubai are also authorized to legit and regulated Forex trading opportunities since the broker is authorized by the DFSA. In addition, with continuous expand Pepperstone established an entity in Kenya while regulated by CMA so the African region is covered as well.

| Pepperstone Strong Points | Pepperstone Weak Points |

|---|---|

| Multiply regulated broker with a strong establishment | Regulatory standards and protection vary based on entity |

| Regulated by ASIC and FCA | |

| Multiple licenses in various regions | |

| Global expands including Asia, MENA, Africa regions | |

| Negative Balance protection |

How are you safeguarded?

The above regulators strictly enforce the required performance, while both ASIC and FCA demand financial services firms follow strict capital requirements, fully segregate traders’ accounts from company funds, comply with internal risk management, training, accounting, audits, and many other requirements. Furthermore, the organization offers Negative Balance protection as well as an automated Risk Management System to ensure customers’ safe trading.

Leverage

Regarding European traders or those with accounts registered with Pepperstone UK, the European ESMA legislation recently cut the maximum allowable leverage for security reasons.

- On Forex products, the maximum leverage level for European customers is 1:30.

- However, leverage levels are determined by entity regulations, just as international offerings are Pepperstone maintains leverage of 1:500 or more for Professional clients on each business.

- However, be sure to understand all you can about leverage and how to utilize it wisely, since increasing your trade size may have a major impact on your prospective revenue or losses.

Account varieties

Pepperstone accounts provide two major account categories, each with the same high quality performance, support, and platform features. Below are some of our observations on Pepperstone accounts:

| Pros | Cons |

|---|---|

| Fast digital account opening | Account types and proposal may vary according to jurisdiction |

| Demo Account free use for 30 days | |

| The proposal between Accounts based on spread only or based on commission | |

| Low minimum deposit |

How can I create a Pepperstone live account?

Opening an account with Pepperstone is simple; just follow the account opening procedures, verify your information, and pick the account type of your choice, as well as the opportunity to switch between Demo and Live Trading modes.

While beginning traders or non-professionals may join up for a Standard Account, a traditional kind with no commissions and institutional grade STP spreads starting at 0.6 pips on the MT4 platform.

A option for expert traders who want to pay commission rather than spread consistency in Razor Account – fee from 3.5$ and spread from 0.0 pip, with variable leverage and superior algorithms for execution speed.

Furthermore, because of its worldwide reach, Pepperstone allows Sharia-compliant traders to open a SWAP Free Account with STP spreads and no fee. In addition, we discovered some more intriguing alternatives, such as Pepperstone, a PAMM Account forex broker that is also appropriate for copy trading or investing.

Reward Program for Active Traders

Active traders with large volume or institutional traders may take use of the Active Trader Program’s unique requirements, which include spreads as low as 0.0 pips, extensive reporting, and a dedicated manager, as well as VPS hosting, bespoke solutions such as API, FX GUI, and certain rebate programs.

Instruments of Trade

CFDs on 70+ currency pairs, Cryptocurrencies (including access to trade Bitcoin, Bitcoin Cash, Ethereum, Dash, and Litecoin against the US Dollar), metals, commodities, and a variety of important indices are available across different broker platforms.

Pepperstone Markets has a variety Score of 8 out of 10 for a diverse trading instrument selection, however the sole difference is that the European company provides primarily CFDs and Forex instruments, while a broader variety is only offered to international clients.

Can I trade cryptocurrencies with Pepperstone?

Yes, you may trade cryptocurrency on the Pepperstone platform; moreover, the conditions are quite appealing, and the range is enough in our view.

However, instruments may differ based on jurisdiction (for example, Crypto CFDs are not offered via CMA or FCA UK entities).

Fees for Pepperstone

According to our study, Pepperstone pricing is structured into a spread or a commission basis, with a choice of account type; moreover, prices and quotations are offered by numerous liquidity sources. As a result, you will get incredibly competitive pricing, with the Pepperstone spread regarded to be among the industry’s lowest spreads.

Based on our research and comparison to over 500 other brokers, Pepperstone Fees are scored low, with an overall rating of 9 out of 10. Fees may vary depending on the company providing; check our findings on fees and prices in the table below; nevertheless, Pepperstone’s total costs are rated reasonable.

Spreads

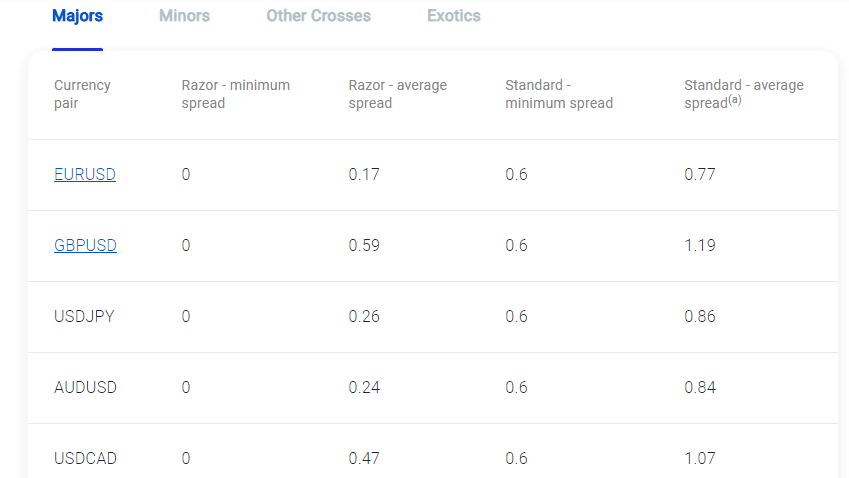

Pepperstone spreads vary depending on whether you have a Standard or Razor account, with the EUR/USD minimum spread beginning at 0 pips and often averaging 0.17-0.77 pips, which is regarded a very attractive offer when compared to other brokers. Bitcoin spreads start at $10, Ethereum spreads start at $4, and Litecoin spreads start at $3.

What exactly is the Pepperstone commission?

Because you will be trading using interbank spread quotes beginning at 0 pips and commission charges are imposed as a trading fee, the commission cost is only applied to Pepperstone Razor Accounts. Pepperstone uses clear terms and a competitive offering of $3.5 per lot for 100,000 USD exchanged.

However, for the most up-to-date information, visit the official Pepperstone website or platform, as well as compare costs with another popular broker, HotForex, and see our comparison table below.

Based on our research and comparison to other brokers, Pepperstone Spreads is scored low, with an overall rating of 9 out of 10. We discovered Forex spreads that are substantially lower than the industry average of 1.2 pips for EURUSD, and spreads for other products are also quite appealing.

Deposits and withdrawals

Pepperstone allows customers to easily fund their accounts in AUD, USD, EUR, CAD, GBP, CHF, JPY, NZD, CAD, SGD, and HKD. Which is an excellent choice, since it means you may save exchange costs and gain from trading in your own currency.

Pepperstone Funding Methods received an Excellent rating of 8 out of 10. The minimum deposit is within the industry’s averages, but fees are either none or extremely cheap, enabling you to profit from a variety of account-based currencies, however deposit possibilities differ by business.

Here are some of the positive and bad aspects of Pepperstone fundraising techniques discovered:

| Pepperstone Advantage | Pepperstone Disadvantage |

|---|---|

| Fast digital deposits, including Neteller, and Credit Cards | Methods and fees vary in each entity |

| 200$ is a first deposit | |

| Multiple Account Base Currencies | |

| 0$ deposits and free withdrawals | |

| Withdrawal requests confirmed 12-24 hours |

Deposit Options

In terms of funding methods, Pepperstone offers numerous payment methods which is very good plus, yet check according to its regulation whether the method is available or not.

- Bank Wire,

- Credit/Debit cards,

- Skrill,

- Local Bank Deposit,

- Neteller,

- Bpay,

- Union Pay

- PayPal

- MPESA