There is no one-size-fits-all answer to the question of the best forex trading strategy, as the effectiveness of a strategy depends on various factors, including the trader’s risk tolerance, trading style, and market conditions. However, I can provide an overview of some popular forex trading strategies that traders commonly use:

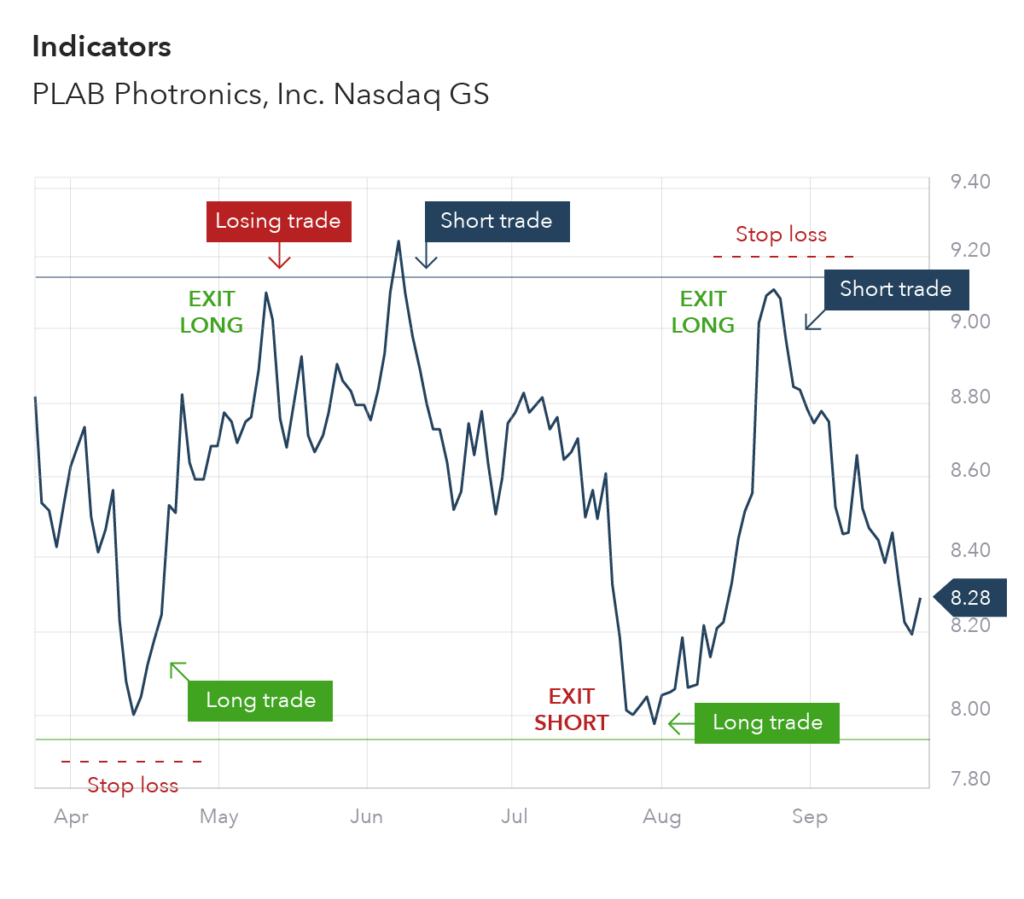

1. Trend Following

- Description: Traders identify and follow the prevailing market trend. They enter long positions in an uptrend and short positions in a downtrend.

- Indicators: moving averages, trendlines, and momentum indicators.

2. Range Trading

- Description: Traders identify horizontal price ranges and aim to profit from price oscillations within those ranges.

- Indicators: support and resistance levels, Bollinger bands.

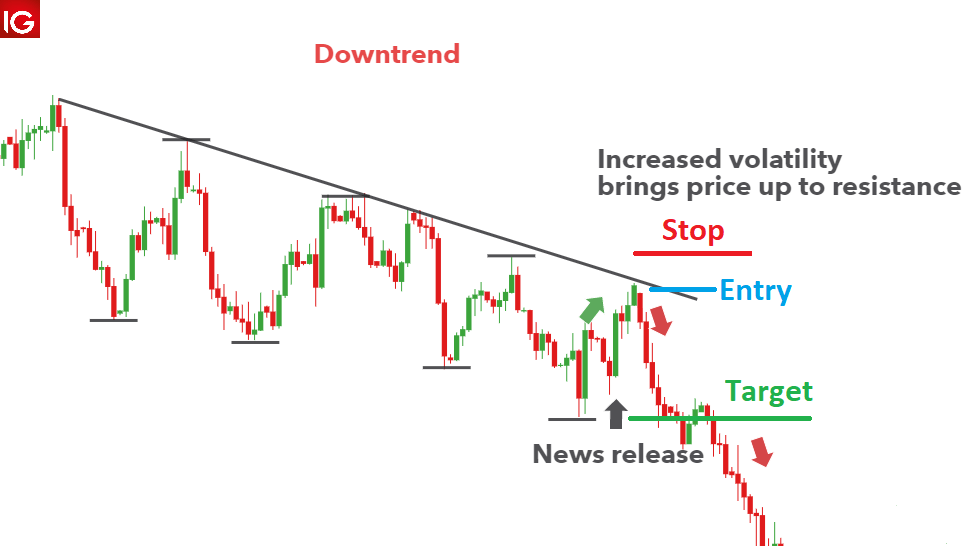

3. Breakout Trading

- Description: Traders identify key levels of support or resistance and enter trades when the price breaks through these levels, expecting a strong move in the direction of the breakout.

- Indicators: support and resistance levels; volatility indicators.

4. Swing Trading

- Description: Traders aim to capture price “swings” within an established trend. Positions are typically held for a few days to weeks.

- Indicators: candlestick patterns, moving averages, RSI (Relative Strength Index).

5. Scalping

- Description: Traders make numerous small trades throughout the day to exploit minor price movements. Positions are typically held for very short periods.

- Indicators: tick charts, one-minute charts, moving averages.

6. Carry Trade

- Description: Traders take advantage of interest rate differentials between currencies. They go long on a currency with a higher interest rate and short on a currency with a lower interest rate.

- Indicators: economic indicators, interest rate differentials.

7. News Trading

- Description: Traders base their decisions on economic news and data releases. This strategy requires quick reactions to market events.

- Indicators: Economic calendars, news feeds.

It’s important for traders to understand that no strategy guarantees success, and risk management is crucial. Additionally, backtesting a strategy on historical data and practicing with a demo account can help traders assess its viability before risking real capital. Many successful traders often combine elements of different strategies to create a personalized approach that suits their preferences and risk tolerance.