Successful forex trading requires a well-defined strategy that aligns with your risk tolerance, trading style, and financial goals. Here are some popular forex trading strategies that traders often use:

Successful Forex Trading

On this page

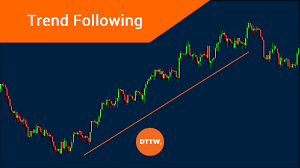

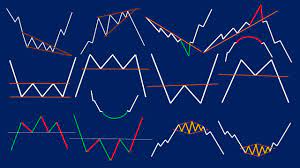

Trend Following

Identify and follow the prevailing market trend. Traders using this strategy aim to enter positions in the direction of the established trend. Technical indicators such as moving averages can be helpful in identifying trends.

Range Trading:

Focus on trading within a defined price range. Traders using range trading strategies aim to identify key support and resistance levels and execute trades when the price approaches these boundaries.

Click here to read Mastering Your Mind: 16 Forex Trading Psychology Tips for Success

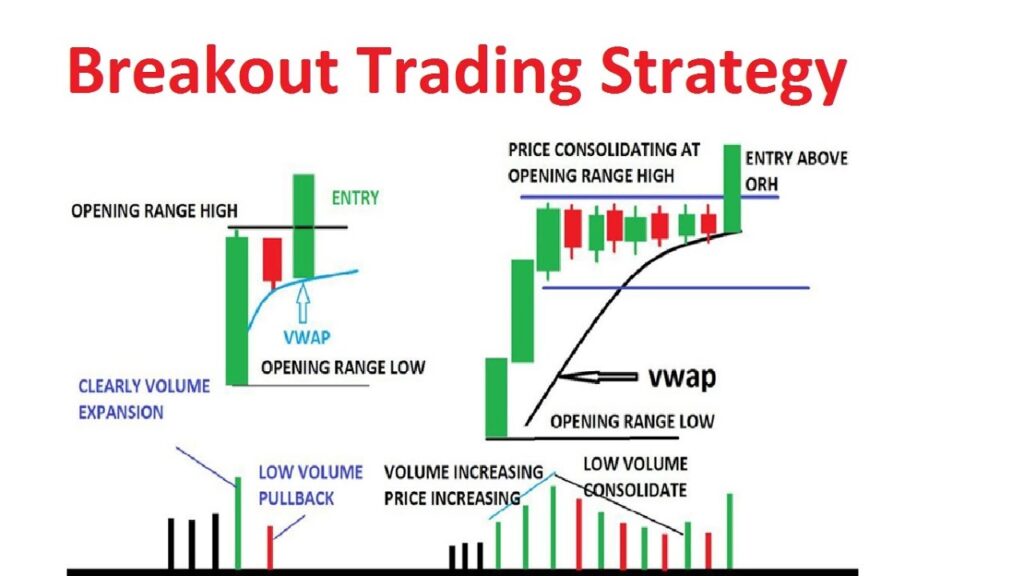

Breakout Trading:

Take positions when the price breaks out of a well-established range. Breakout traders aim to capitalize on significant price movements that may follow a breakout from a consolidation phase.

Swing Trading:

Capture price swings within a trend. Swing traders typically hold positions for a few days to weeks, aiming to profit from short to medium-term price movements.

Scalping:

Execute numerous small trades throughout the day to capture very small price movements. Scalpers focus on short-term market fluctuations and aim to make quick, small profits.

Carry Trading:

Capitalize on interest rate differentials between two currencies. Carry traders go long on a currency with a higher interest rate and short on a currency with a lower interest rate, aiming to earn the interest rate spread.

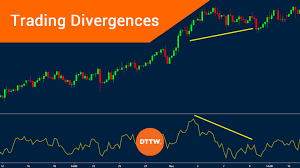

Divergence Trading:

Look for discrepancies between price movements and technical indicators. Divergence traders use indicators such as the Relative Strength Index (RSI) or MACD to identify potential reversals in the market.

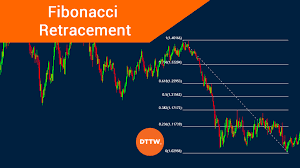

Fibonacci Retracement:

Use Fibonacci retracement levels to identify potential reversal points in a trend. Traders often use these levels to determine entry and exit points based on the historical price retracements.

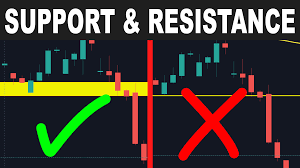

Support and Resistance Trading:

Identify key support and resistance levels and trade based on the interaction of the price with these levels. Breakouts, bounces, and reversals can be traded using this strategy.

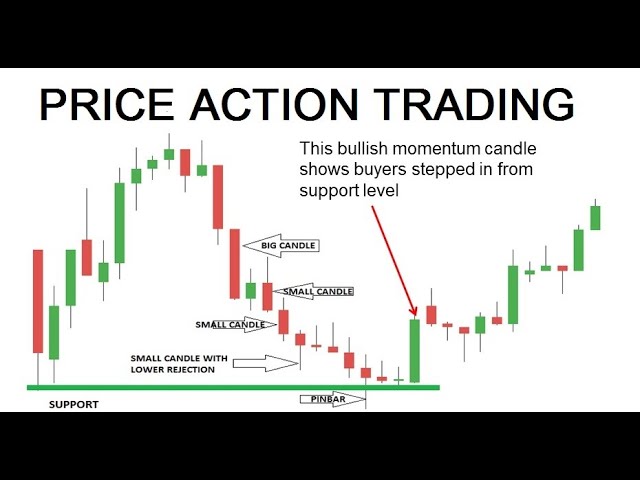

Price Action Trading:

Analyze price movements and chart patterns without relying heavily on indicators. Price action traders make decisions based on the actual price movements on the chart.

News Trading:

Capitalize on market volatility generated by economic news releases. News traders aim to enter positions before or after significant economic events based on their impact on currency values.

Pattern Trading:

Recognize chart patterns such as triangles, flags, and head and shoulders formations. Traders using pattern recognition look for predictable price movements based on historical chart patterns.

Algorithmic Trading (Automated Trading):

Develop and deploy automated trading algorithms that execute trades based on pre-defined rules. Algorithmic trading can be used for various strategies, including trend following, arbitrage, and statistical analysis.

Conclusion

It’s important to note that no strategy guarantees success, and each comes with its own set of risks. Additionally, traders often combine elements of multiple strategies to create a personalized approach that suits their preferences. Successful trading requires discipline, risk management, and continuous learning. Before implementing any strategy, it’s advisable to test it thoroughly in a demo account and only transition to live trading when confident in its effectiveness.