- The Australian Dollar inches higher due to improved market sentiment.

- Australia’s monthly CPI is estimated to have grown at a faster pace of 3.8% in May.

- The US Dollar drops as investors see the Fed reducing interest rates twice this year.

The Australian Dollar (AUD) moves higher to near 0.6670 against the US Dollar in Tuesday’s European session. The Aussie asset gains as the market sentiment is favorable for risk-perceived assets due to improved expectations that the Federal Reserve (Fed) will start easing interest rates from the September meeting.

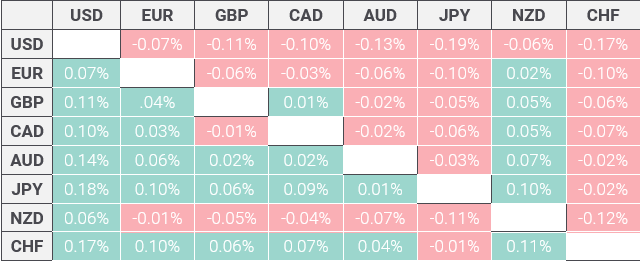

S&P 500 futures have posted decent gains in European trading hours, indicating an improvement in investors’ risk appetite. The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, struggles to gain ground after correcting from a seven-week high of 105.90. 10-year US Treasury yields remain sluggish at near 4.25%.

The CME FedWatch tool shows that traders have priced in two rate cuts this year against one signaled by Fed policymakers in the latest dot plot. Softer-than-expected May inflation data prompted expectations that the Fed would begin reducing key rates early.

For more clarity on inflation, investors will focus on the US core Personal Consumption Expenditure price index (PCE) for May, which will be published on Friday. The core PCE price index data is the Fed’s preferred inflation measure, which will provide fresh cues on when and how much the central bank will reduce interest rates this year. The annual core PCE is expected to have decelerated to 2.6% from the prior release of 2.8%. On month, the inflation data is estimated to have grown at a slower pace of 0.1% from 0.2% in April.

Meanwhile, the Australian Dollar exhibits strength ahead of the monthly Consumer Price Index (CPI) data for May, which will be published on Wednesday. Aussie inflation is expected to have accelerated to 3.8% from 3.6% in April, which will force the Reserve Bank of Australia (RBA) to leave interest rates at their current levels for a longer period. Currently, financial markets expect that the RBA will not cut its Official Cash Rate this year.

Australian Dollar Price Today: