The Australian Dollar (AUD) is rising as the week begins despite a slight dip in the US Dollar (USD). This comes as the ASX 200 Index continues its winning streak, mainly boosted by gains in the mining and energy sectors. Additionally, the AUD is strengthened by a more muscular Chinese Yuan (CNY), with the People’s Bank of China (PBoC) setting the mid-rate for the onshore yuan higher than expected.

Meanwhile, the US Dollar Index (DXY) is undergoing a correction after reaching a five-week high in the previous session. The USD might face downward pressure as ongoing US data shapes expectations for the Federal Reserve (Fed) easing cycle, anticipated to start in June. Fed Chair Jerome Powell has reassured markets that the central bank won’t hastily react to recent inflation increases.

In other market news, Australian Employment Change for February exceeded expectations, while the Unemployment Rate dropped to 3.7%. The Australian government has pledged to support a minimum wage increase aligned with inflation, recognizing the challenges faced by low-income families.

China’s Premier Li Qiang has highlighted the nation’s flexibility for macroeconomic policy adjustments, given its low inflation rate and central government debt ratio. Additionally, Federal Reserve Bank of Atlanta President Raphael Bostic revised his earlier forecast of two interest rate cuts to just one, citing persistent inflation and stronger-than-expected economic data.

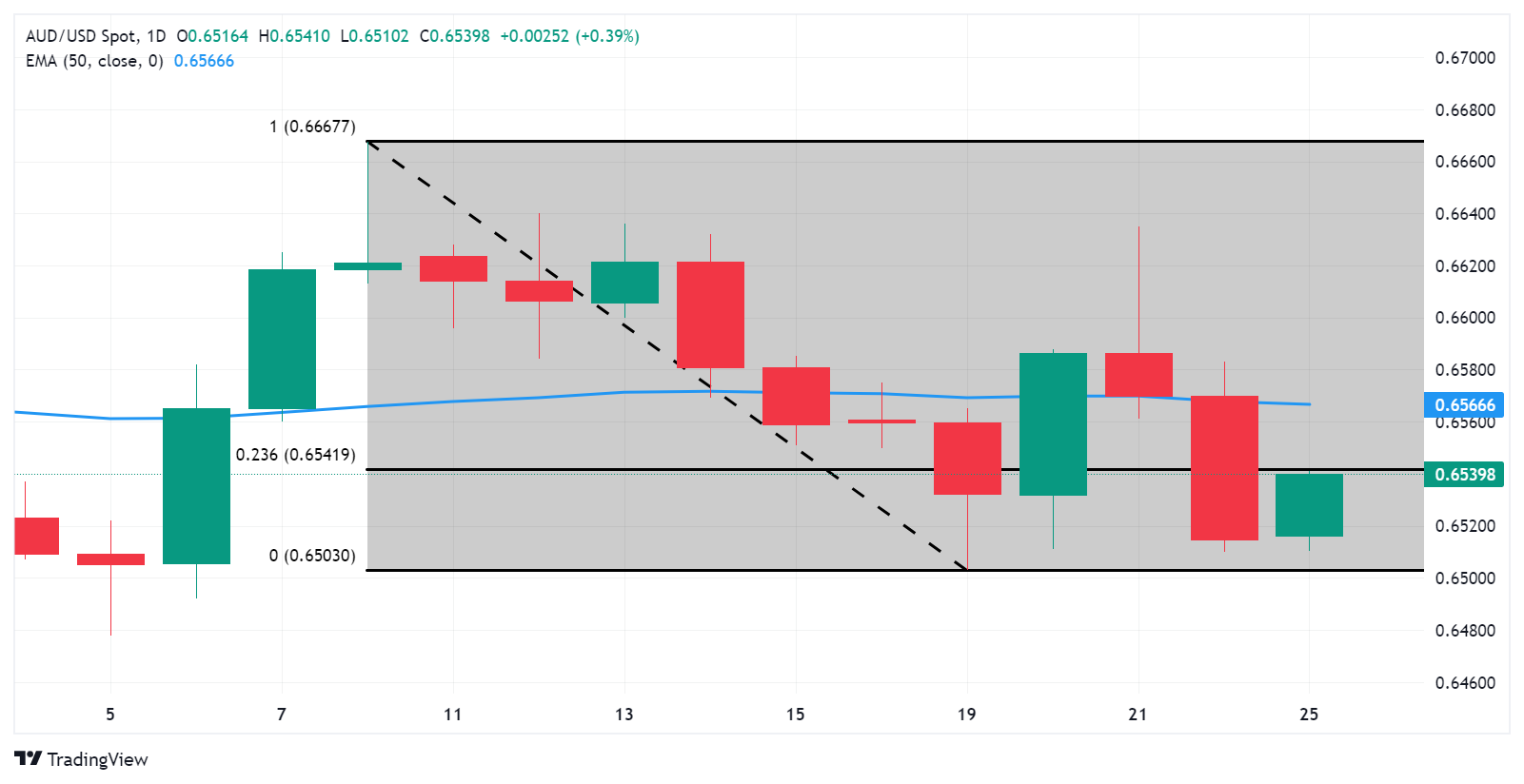

Looking at technical analysis, the AUD is hovering near 0.6540, with resistance seen at the 23.6% Fibonacci retracement level. A breakthrough could lead to further gains, while key support lies at the psychological level of 0.6500.

AUD/USD: Daily Chart

Australian Dollar price today

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the strongest against the US Dollar.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | -0.09% | -0.11% | -0.08% | -0.16% | -0.02% | -0.12% | -0.02% | |

| EUR | 0.10% | -0.02% | 0.01% | -0.05% | 0.08% | 0.03% | 0.06% | |

| GBP | 0.10% | 0.02% | 0.03% | -0.02% | 0.08% | 0.04% | 0.08% | |

| CAD | 0.07% | -0.01% | -0.03% | -0.07% | 0.05% | 0.00% | 0.05% | |

| AUD | 0.16% | 0.06% | 0.04% | 0.07% | 0.10% | 0.03% | 0.12% | |

| JPY | 0.02% | -0.06% | 0.02% | -0.03% | -0.11% | -0.07% | 0.01% | |

| NZD | 0.07% | 0.02% | 0.01% | 0.03% | -0.05% | 0.08% | 0.10% | |

| CHF | 0.04% | -0.06% | -0.07% | -0.03% | -0.12% | 0.02% | -0.05% |

INFLATION FAQS

What is inflation?

Inflation measures the rise in the price of a representative basket of goods and services. Headline inflation is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core inflation excludes more volatile elements such as food and fuel which can fluctuate because of geopolitical and seasonal factors. Core inflation is the figure economists focus on and is the level targeted by central banks, which are mandated to keep inflation at a manageable level, usually around 2%.

What is the Consumer Price Index (CPI)?

The Consumer Price Index (CPI) measures the change in prices of a basket of goods and services over some time. It is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core CPI is the figure targeted by central banks as it excludes volatile food and fuel inputs. When Core CPI rises above 2% it usually results in higher interest rates and vice versa when it falls below 2%. Since higher interest rates are positive for a currency, higher inflation usually results in a stronger currency. The opposite is true when inflation falls.

What is the impact of inflation on foreign exchange?

Although it may seem counter-intuitive, high inflation in a country pushes up the value of its currency and vice versa for lower inflation. This is because the central bank will normally raise interest rates to combat the higher inflation, which attracts more global capital inflows from investors looking for a lucrative place to park their money.

How does inflation influence the price of Gold?

Formerly, Gold was the asset investors turned to in times of high inflation because it preserved its value, and whilst investors will often still buy Gold for its safe-haven properties in times of extreme market turmoil, this is not the case most of the time. This is because when inflation is high, central banks will put up interest rates to combat it. Higher interest rates are negative for Gold because they increase the opportunity-cost of holding Gold vis-a-vis an interest-bearing asset or placing the money in a cash deposit account. On the flipside, lower inflation tends to be positive for Gold as it brings interest rates down, making the bright metal a more viable investment alternative.