The July JOLTs report reinforced the cooling labour market narrative, though largely due to reduced hiring rather than widespread layoffs. Job openings declined slightly to 7.18m (prior: 7.36m), marking the first time since April 2021 that the ratio of job openings to job seekers dropped below 1.0. At the same time, hiring remained steady at 5.3m, while involuntary layoffs and WARN notifications for mass layoffs stayed at historically modest levels. Overall, firms seem to be refraining from aggressive cost-cutting measures, underscoring underlying stability.

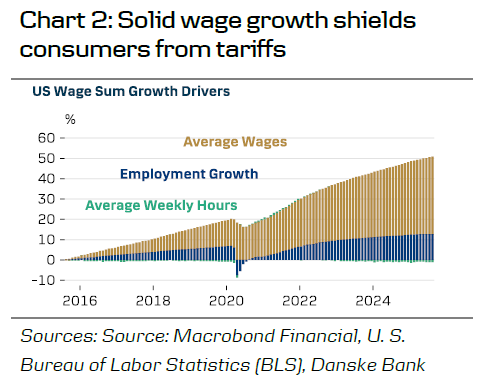

Despite signs of moderation, wage growth remains robust. With an annualised pace of 4.4%, wage sum growth, driven by rising nominal wages (chart 2), continues to shield consumers from cost pressures and support demand. Importantly, the labour income share remains historically low (chart 3), enabling firms to absorb higher wages without straining profit margins.

Looking towards 2026, expansionary fiscal policy is likely to support the labour market, reducing the risk of a sharp collapse. While headline figures suggest significant weakening, underlying dynamics indicate supply constraints as the primary driver. As a result, we do not think the Fed is under pressure to cut interest rates aggressively.

We do expect the Fed to resume rate cuts from September, but progress only gradually with one cut per quarter. In comparison, markets have almost fully priced in 25bp cuts for all three of the remaining meetings this year.