Leading up to the Fed today, the incoming data is better than the not-bad we expected.

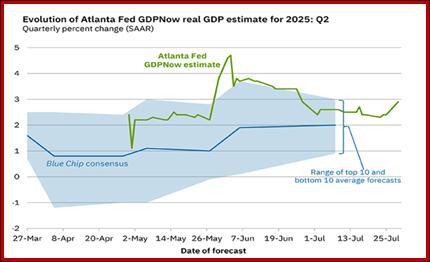

The trade deficit was smaller. Job openings fell a bit but consumer confidence is better. We will get GDP later today but we already have the revision from the Atlanta Fed, and it’s a stunner—2.9%.

We also get the ADP private sector payrolls, a scary -33,000 last time and likely about 75,000 today.

Today is a big day featuring the Fed rate decision this afternoon. Before then, we need to soak in that the Treasury market is in fine fettle. Treasury yields have dropped substantially on the auctions so far, including yesterday’s 7 year and the wild drop in the 10-year to the lowest since July 3. If foreigners or anyone else were shunning US paper, yields would be going up.

Despite all this upbeat data and attitude, the relief rally on trade uncertainty is still a two-legged stool. The IMF may not see a big amount of overall global damage, but it can get worse. According to Goldman Sachs, trading partners accounting for 56% of US imports do not have deals. That includes Canada, Mexico, South Korea, Brazil and India.

There is still a row to hoe. Not only can Trump demand unreasonable tariffs from those still remaining—including China—he is erratic and impulsive enough to change the deals we think are done. As every analyst notes, not a single legally binding deal has been done. Because Trump lies and changes his stories on a whim, the trade war is not over. In fact, we will probably have to live with it for the next 3½ years.

Bottom line, relief is premature and based so far on the idea “it could be worse.” And that’s not even counting the geopolitical aspects. Trump wants the EU and others to shun China. India, for one, is not about to do that. For its part, China is not about to shun Russia. Then there’s Ukraine. Mixing up geopolitical factors with trade “policy” is a delicate business for which nobody in the current administration is qualified. Well, SecState Rubio, but he gave up his credibility and brainpower when he became a toadie, so don’t count on him.

Forecast: We expect a euro drop to the ATR line at 1.1342 (at least). We often see the midpoint of the 38% and 50%, and that lies at 1.1090, but as of today, that seems a bridge too far.

This breakout move is fresh but powerful and not likely to be false. The one thing that could turn it around would be the Fed getting two or more votes for a cut and/or the press conference comments strongly hinting that Sept is a done deal. The Fed doesn’t give forward guidance like it used to but that doesn’t stop the analysts from reading the tea leaves.

Stiff-backed economists want the Fed to stick to “wait and see” but the strong hint of September has a few things going for it, including validating the CME bettors and taking some of the vinegar out of Trump.

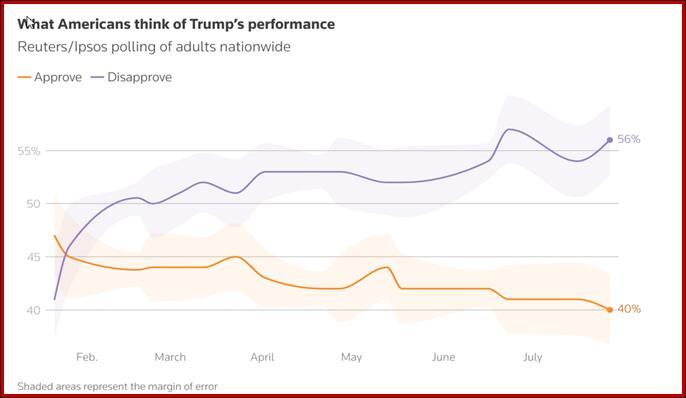

Tidbit: See the Reuters poll showing disapproval of Trump but don’t be fooled—the approval rating among Republicans alone if very high—up to 90% on various issues like immigration and even the economy. The only subject where disapproval is higher than approval is the Epstein issue. Trump is behaving like the entrenched deep state elite he promised to kick out of Washington.

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.