The hall of mirrors

The Fed just pulled its scalpel for a quarter-point trim to 4.00–4.25%. On the surface it looked like consensus—11-1 with only Miran banging the table for a 50bp gash. Powell dressed it up as “risk management,” but traders know when the captain says “there are no risk-free paths,” you’re in waters where compasses start to spin and maps don’t help.

What should have been a straight dovish script turned into a Rorschach test. Dots pointing to more cuts, however, the press conference muddied everything.

Markets flipped twice in an hour—yields dropped, dollar sank, then just as quickly inverted higher as Powell refused to baptize inflation as “transitory” or tame the tariff spectre. What’s left is not clarity but noise—more like CTA algos chasing each other in a hall of mirrors than any lasting re-pricing.

The bigger issue is political gravity creeping into the Fed. Trump’s “ringer” on the Board arguing for oversized cuts feeds the market’s suspicion that independence is a mirage. When traders smell politics bleeding into the mandate, they assume the policy curve itself can kink without warning. That perception alone adds another layer of risk premium into every FX spread.

Still, today’s dollar pop feels like a rare sunbeam in an overcast sky. Positioning was heavy short into the decision, so some fast hands had to scramble. But structurally, the tide hasn’t changed—cheapening dollar funding into year-end, seasonal weakness, and a Fed now openly leaning toward jobs over prices. The greenback may strut for a session or two , but the longer script is depreciation. The roadmap is obvious: next week, every dovish Fed speaker opens the door wide, then the NFP cracks open even wider.

Elsewhere, the yen had its knees taken out by Takaichi’s LDP candidacy—a clear pro-stimulus voice that adds another layer of policy uncertainty. It gave the JPY’s tactical bid just as U.S. yields were rebounding, but again, this is more rip than trend.

At the European open, EUR/USD’s whipsaw back below 1.180 was more about book-squaring than fresh conviction. Fair value sits closer to 1.185-7; I still see 1.19–1.20 as the gravitational pull once the NFP dust settles.

Bottom line: This cut wasn’t the Fed calming the storm—it was Powell circling the wagons around a campfire that’s already throwing off unemployment sparks. The dollar’s bounce is a trader’s reprieve, not a regime shift. Sell strength into the next jobs wobble remains the cleanest play on the board.

Powell’s last tango

There was no jumbo 50bp slash from the Fed. Only Stephen Miran — still warming his chair — pushed for it. Everyone else fell in line around a modest quarter-point trim. The real story wasn’t the cut itself, but the silence around it. Traders were waiting for a loud crack in the committee’s unity — and instead, nothing. Sometimes the loudest market signal is the one that never comes.

Markets spun in place like a compass on a magnet. At first blush it was dovish: a trim, a softer jobs lens, Powell conceding he could no longer call the labor market “very solid.” But then the “hawkish cut” narrative kicked in. Stocks ended flat, front-end yields barely moved, yet the dollar and the long bond pushed higher. Classic tells of a market deciding that the Fed’s hand was lighter than the dots implied.

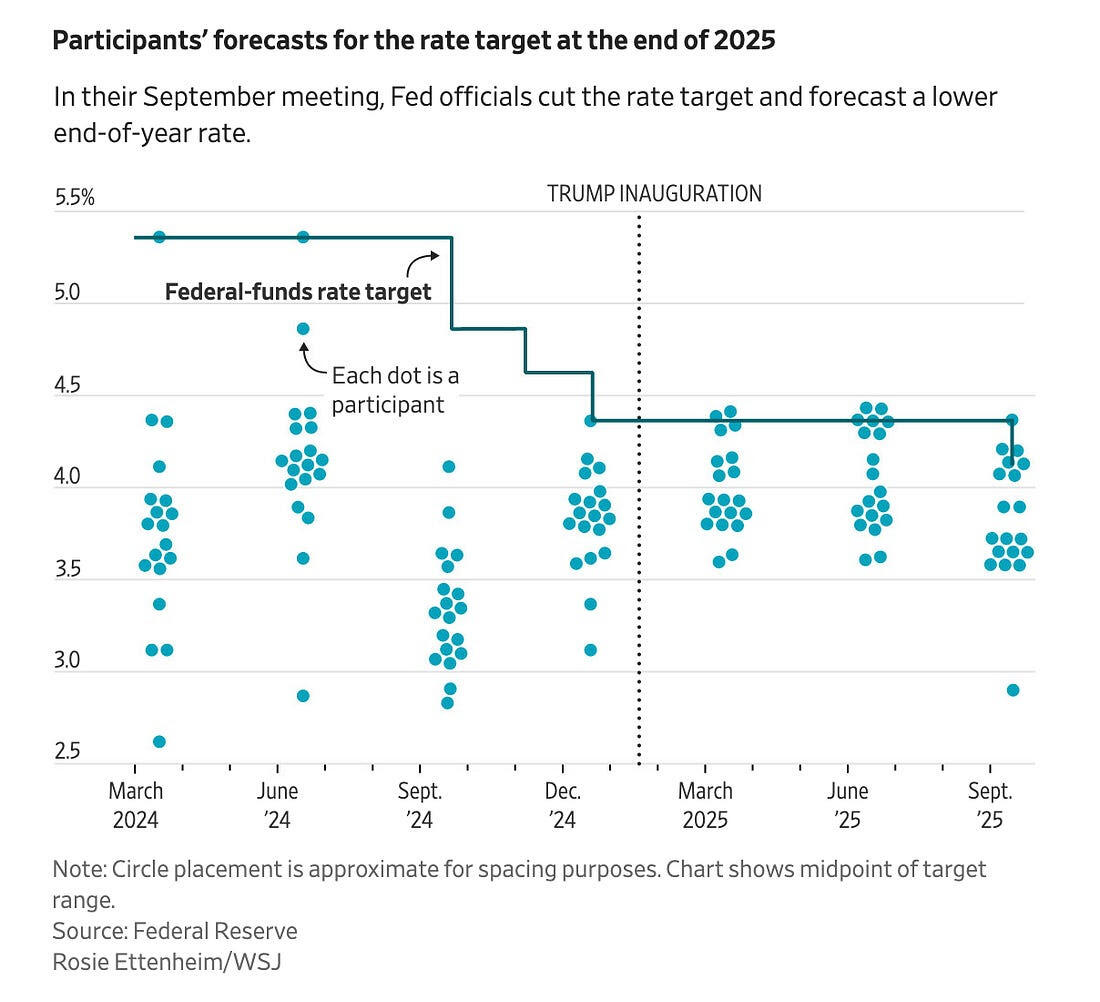

Powell’s presser was pure risk-manager theater. He leaned harder into jobs than inflation, but hedged with lines any trader could mutter after a bad day: “It’s challenging to know what to do,” and “there are no risk-free paths now.” That doesn’t anchor markets — it just keeps everyone guessing. The dots themselves barely shifted, still pointing to rates north of 3% through 2027, even as Trump openly talks about wanting 1%. Futures barely budged, a sign the market thinks the Fed hasn’t dropped the real shoe yet.

The outlier dot — Miran’s below-3% dream by year-end — looked more like graffiti than guidance. Historically, cuts of that magnitude only happen when the system itself is breaking. He claims to want more diversity of thought at the Fed, but when your first play is to scream “crisis,” it reads less like independence and more like a stunt.

What mattered more was who didn’t break ranks. Waller and Bowman had dissented in July and could have used another dramatic vote to polish their credentials for the chairmanship once Powell exits. They didn’t. They knew Trump would smile on jumbo cuts, yet still stood with the majority. That restraint sent ripples far beyond the rates market. Betting odds on Fed succession twitched wildly — Miran briefly topping the Kalshi board — but by the end it was Waller’s discipline, not Miran’s noise, that carried weight.

This tells us two things. First, the FOMC may still have a center of gravity that resists pure political capture. Independence may not be dead yet. Second, the next true inflection point isn’t in the dots or Powell’s hedges — it’s when this bloc of governors holds veto power over regional Fed presidencies early next year. That’s the moment when the board could hard-wire Trump’s influence into the machinery.

For FX, the cut played out as a hawkish feint: the dollar grabbed a rare day in the sun, yields tilted higher, but conviction was thin. This was less the start of a new dollar bull run and more a short-covering squall. The absence of the “signal that never came” mattered more than the noise of Miran’s howl — and for those trading the greenback, that silence keeps the longer-term bearish script intact.