In forex trading, various tools can assist traders in implementing effective risk management strategies. Here are some common forex risk management tools used in the forex market:

Forex Risk Management Tools

Stop-Loss Orders

A stop-loss order is a fundamental risk management tool. Traders set a predetermined price level at which a losing position will be automatically closed. This helps limit potential losses.

Click here to read Mastering Your Mind: 16 Forex Trading Psychology Tips for Success

Take-Profit Orders

Similar to stop-loss orders, take-profit orders automatically close a position when a predetermined profit level is reached. It ensures that traders lock in profits at desired levels.

Trailing Stops:

Trailing stops automatically adjust as the price moves in favor of a trade. If the market price moves in the direction of the trade, the stop-loss order is adjusted to lock in profits, helping to maximize gains while protecting against reversals.

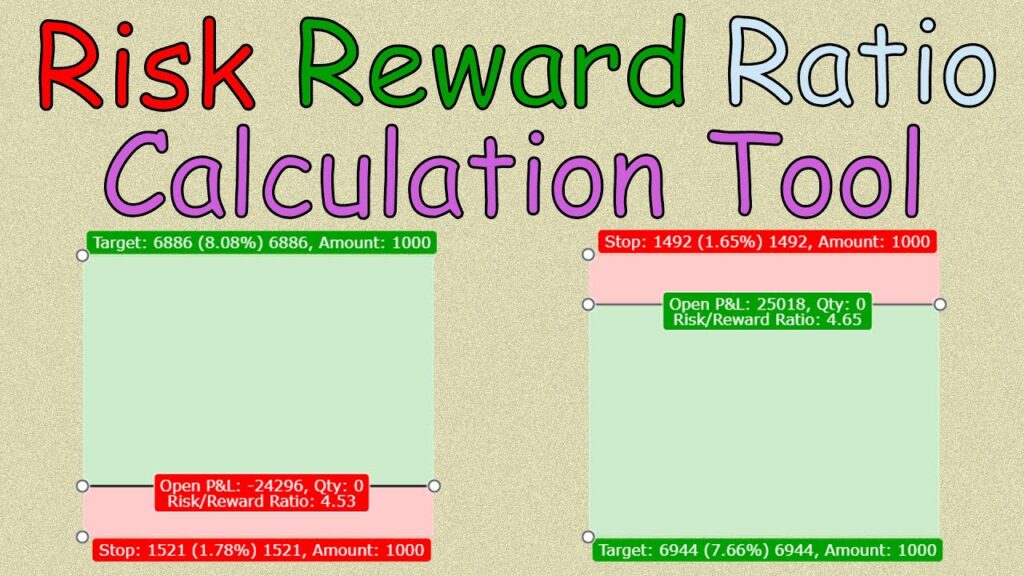

Risk-Reward Ratio Calculators:

These tools help traders assess the potential risks and rewards of a trade before entering. By inputting the entry price, stop-loss level, and take-profit level, traders can evaluate the risk-reward ratio.

Position Size Calculators:

Calculating the appropriate position size is crucial for risk management. Position size calculators help traders determine the number of units or lots to trade based on their risk tolerance, account size, and stop-loss level.

Volatility Indicators:

Volatility indicators, such as the Average True Range (ATR), provide insights into market volatility. Understanding market volatility is important for setting appropriate stop-loss levels and position sizes.

Margin Calculators:

Margin calculators help traders determine the required margin for a trade, considering leverage. This tool assists in preventing overleveraging, which can lead to larger-than-intended losses.

Correlation Analysis Tools:

Correlation analysis helps traders understand the relationships between different currency pairs. By assessing correlations, traders can avoid overexposure to similar currency movements and diversify their portfolios.

Economic Calendars:

Economic calendars provide schedules of important economic events and releases. Traders can use this information to anticipate potential market volatility and adjust their risk exposure accordingly.

Trade Journals:

While not a traditional tool, keeping a trade journal is an effective way to review and analyze trades. Traders can track their decision-making process, identify patterns, and learn from both successful and unsuccessful trades.

Demo Accounts:

While not a tool per se, demo accounts allow traders to practice risk management strategies in a simulated environment. This helps them refine their skills and test their approach without risking real money.

News and Alert Services:

Services that provide news alerts and notifications about market-moving events can help traders stay informed and respond promptly to changes in market conditions.

It’s important to note that while these tools can be beneficial, they are most effective when used as part of a comprehensive risk management strategy. Successful risk management involves a combination of these tools along with a disciplined approach to trading, continuous education, and the ability to adapt to changing market conditions.