The Dollar is showing it still knows how to throw its weight around. Beijing has turned the fixing screws tighter on USD/CNY, dialing the yuan higher for two straight sessions and undercutting the narrative that a managed appreciation was the path of least resistance. At the same time, Washington is sharpening tariff drafts aimed at BRICS after Beijing’s summitry—enough to jolt EM FX, where portfolios are already bloated with overweight bets. A dollar on the ropes suddenly finds a second wind.

Flows add muscle to the move. September is the taxman’s gauntlet, when U.S. corporates vacuum up dollars for payments, sometimes wrenching money markets out of joint. Traders still recall the dislocations of 2019. Layer that with the statistical quirk that DXY has risen in seven of the last ten Septembers, and you get a sense of why this isn’t one-way traffic to a softer greenback. Payrolls may underwhelm, and Fed cuts may loom, but the plumbing and seasonality are a hidden undertow, lifting the dollar when consensus had already signed its obituary.

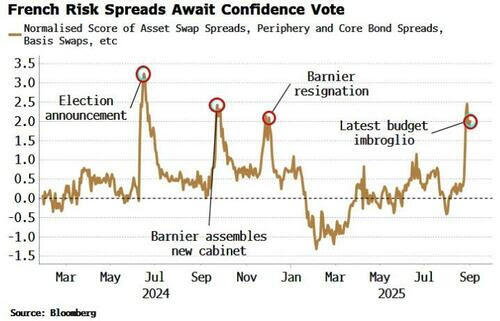

Across the Atlantic, France is the live grenade. Bund spreads show polite concern, but the holistic dashboard—CDS, asset swaps, cross-currency basis, equity-bond premia—has widened to levels unseen since Macron’s snap election fiasco. Bayrou’s bleak admission that “compromise may not be possible” cracked across the tape like a stop-loss trigger. Spreads ratcheted wider, periphery paper flinched, and suddenly Paris feels less like a sovereign and more like a wobbly corporate credit. Bond spreads are the whisper, but the real story is the scream across correlated instruments. Contagion doesn’t announce itself—it seeps sideways until the whole dashboard is glowing red.

And then, as if to remind us the political axis isn’t just tilting in Europe, Tokyo dropped its own tremor this afternoon. LDP secretary-general Moriyama offered to fall on his sword after July’s upper house drubbing, with key lieutenants reportedly lining up to follow. For a prime minister already under siege, this is no small aftershock. The yen promptly wilted as traders priced in a leadership vacuum risk. A currency that has been leaning on rate differentials and yield-curve control suddenly has to swallow political uncertainty too. When the core of the ruling bloc frays, the market reacts first and asks questions later.

So we step into September with a three-front story: a dollar buoyed by flows and seasonal quirks, a France where political fracture is bleeding into every corner of the risk lattice, and a Japan where leadership uncertainty has elbowed its way onto the trading blotter. The consensus trade—that the dollar softens and vol stays suppressed—feels like betting the roulette wheel will keep landing black. The table is shifting under us. For traders, this isn’t about straight-line forecasts. It’s about keeping one hand on the exit button and the other on the opportunity key, because the tape is alive again, and September is whispering trouble in three languages at once.